Mutual Fund, ETF Product Videos Hit Their Storytelling Stride

/ TweetStories not style boxes.

A recent paper from LPL Research Private Client Thought Leadership (this link opens a PDF) makes a valid point: While the investment industry tends to communicate in style boxes, what investors react to is stories—or themes, to use LPL’s word (and in a foreshadowing of its thematic portfolios to come).

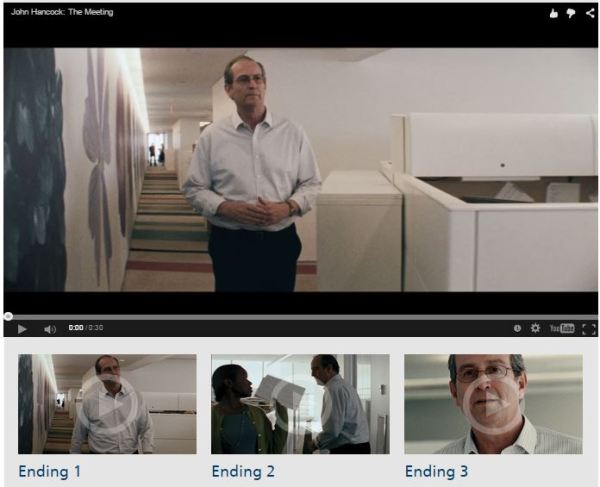

There may be no better storytelling format than video. In fact, recently surveyed marketers said video is the most effective social content.

And yet asset manager use of video has struggled to fire on all cylinders. The Compliance requirement to script on-camera talent, the often stilted deliveries and the very messages themselves have fallen flat. Some firms have hesitated to use YouTube to expose their videos to the broadest audience possible. Many firms that publish on YouTube have neglected to throw any search engine optimization support behind them.

Video views of fund company videos hang in double-digit land even as survey after survey ranks video high on the list of advisor and investor social influences.

Whose videos are making an impression? Videos produced by other than asset managers, that's been my nagging suspicion.

New Energy

Despite a lack of public positive reinforcement (i.e., view count), many mutual fund and exchange-traded fund (ETF) firms have steadily improved upon their use of video, and the effort is showing:

- Almost every leading firm—American Funds, DFA, Davis Funds, you name it—showcases at least one video on its home page.

- Strategists, portfolio managers and others are taking chill pills. Almost gone are the deer-in-headlights teleprompter-scanning deliveries of yore that made many videos uncomfortable to watch.

Talking heads are displaying a new energy, thanks in part to not being tethered to a script. For one of my favorites among the new breed of videos: check out (click here to get to the Brightcove video) how MFS Chief Investment Strategist James Swanson renders both the question-asker and question title slide obsolete. He stares directly into the camera, asks himself a question and then answers it.

- Most important and back to the point of this post, there's an evolution toward product “stories,” consistent with what LPL is calling for and more aligned with what people will care about.

It's possible that a video featuring a portfolio manager expanding on a fund’s investment objective or process might attract a narrow audience. Loyalists might watch all of a strategist’s sweeping account of the past or coming quarter.

But the improved product-related videos serve up specific, often illustrated answers to questions that a YouTube searcher may very well be asking.

Making An Investment Case

If the story leads with the why as opposed to the who and the how, a product-centric video can be engaging, as shown in this U.S. Funds’ video on JETs.

Presenting The Opportunity

Here’s WisdomTree effectively delivering a presentation about the opportunity in emerging markets.

Currency Hedging Made Simple(r)

IndexIQ takes on the topic of currency hedging in three short videos that intersperse currency-related questions to keep viewers engaged. See the questions starting at 1:44 in this part 2 video.

What We're Buying And Why

ETFs, especially those in niches, have a storytelling advantage, to be sure. But this Royce Premier Fund video acknowledges that advisors/investors also want to hear more about what’s in their mutual fund—and maybe especially changes to the portfolio’s composition.

Starting at 0:46 (click on the image to go to the site), listen to the portfolio managers describe a few companies recently added to the Royce Premier Fund and why.

None of this used to happen—let alone made available for the public via video. Video truly offers the capability to better inform advisors and investors, as these firms are demonstrating. The content has real value. The next hurdle to clear is to assure that these good stories find their audience.