An Armchair View Of The Digital Decisions Underlying The Schwab/Wealthfront Dust-up

/ TweetPull up a seat to one of the more captivating online brand-to-brand exchanges we’ve been in a position to witness in the investment industry. Although the interaction happening this week between Charles Schwab and Wealthfront is fascinating on many levels, I’ll limit this post to just observations on the decisions underlying the digital communications. RIABiz, InvestmentNews and plenty of others will keep you up to date on the substance.

This evolving communications case study has to do with the emergence of robo-advisor services and controversy surrounding their claims. But, there’s potential for plenty of other contentious discussion this year (can you say smart beta?) that hits even closer to home for mutual fund and exchange-traded fund (ETF) firms.

So much of investment communications is planned, scripted and timed, leading marketers to believe that they have things under control. My question for you, prompted by the interactions discussed below: To what extent do your communications plans anticipate not just what you have to say but how others might respond?

Early on, firms may have been apprehensive about chaotic social platforms filled with trolls waiting to take money managers on. Thankfully, that hasn’t materialized.

Instead, what we are increasingly seeing are informed commentators, including product and distribution competitors as well as financial advisors themselves, publishing thoughtful counterpoints and challenges on their own blogs and content platforms.

Asset managers know they need to respond to the random tweet. That's so 2012.

But a precious few are 1)demonstrating that they’re paying attention to what’s being blogged about 2)posting a response, whether on their own blogs or in a comment to the original posts. Blog posts can be forever. Whatever stance your firm takes—to acknowledge, respond, ignore or be ignorant of them—will have consequences.

The saga playing out this week may help frame your firm’s preparedness, including where, when, how and to whom to respond.

What Happened

By way of background: On Monday morning, Schwab announced “a fully automated investment advisory service,Schwab Intelligent Portfolios, the only investment advisory service using sophisticated computer algorithms to build, monitor, and rebalance diversified portfolios based on an investor’s stated goals, time horizon and risk tolerance—without charging any advisory fees, commissions or account services fees.”

In response, on the same day, the CEO of Wealthfront, one of the startups expected to be most impacted by this service, wrote a scathing blog post. Adam Nash accused Schwab of falsely stating that its service was free because the firm will extract net revenue earnings from interest on the cash allocation of the recommended portfolios. Nash went on to say that “hidden fees" are contrary to the history of Schwab, concluding that the firm has “broken values.”

“Charles Schwab has become Merrill Lynch,” writes Nash, not intending it as a compliment.Less than 24 hours later, Schwab published what RIABiz described as a “rapid-response-counter-punch” reply to Wealthfront’s response. The piece called out Nash's "very loose interpretation of facts" and presented a three-point clarification.

What follows is what this geek noticed and wondered about as all this interaction was taking place online.

The Wealthfront Post

Ladies and gentlemen, what we have here is a classic case of “newsjacking” on Wealthfront’s part. (See the David Meerman Scott site for more.)

This is not to take away from the import of its message. It’s to acknowledge that Nash’s fast-acting response assured that his perspective would be part of the conversation at the precise moment when Schwab would be getting attention. Nash successfully grabbed some of that attention for his view and business.

What helped this succeed: A strong value proposition (there’s no time to crystallize your story when news is breaking), compelling visual assets (including two borrowed from Schwab—ouch!) and Twitter followers/supporters. This program has been in the works for a while, and Nash was prepared for the announcement.

Most of the readers of this blog will be in Schwab’s position. Although once a challenger itself, Schwab today has almost $2.5 trillion in assets. Count on the fact that this launch (big and good news from the company’s perspective) was carefully orchestrated, including a national online, print and television advertising campaign, media outreach and finely crafted talking points. Yet within hours, a single blog post from the CEO of a firm that manages $2 billion (gained in three years) became part of the story and threatened to disrupt the best laid plans.

Did offense need to switch to defense? One can only imagine the drill that took place within Schwab’s communications team. For starters, how did they hear about the post—via their social media monitoring or did they get a heads-up? At the center of the discussions must have been this: “Do we dignify the post with a response?” The implication being that acknowledging the post could call more attention to it.

In fact, here are a few of the choice headlines that resulted:

- Schwab defends amount it parks in cash in new robo-adviser unit

- Gloves Come Off as Robo Rivals Brawl over ETF Portfolios

- Robo-Advisor Cat Fight Breaks Out

Where The Responses Took Place

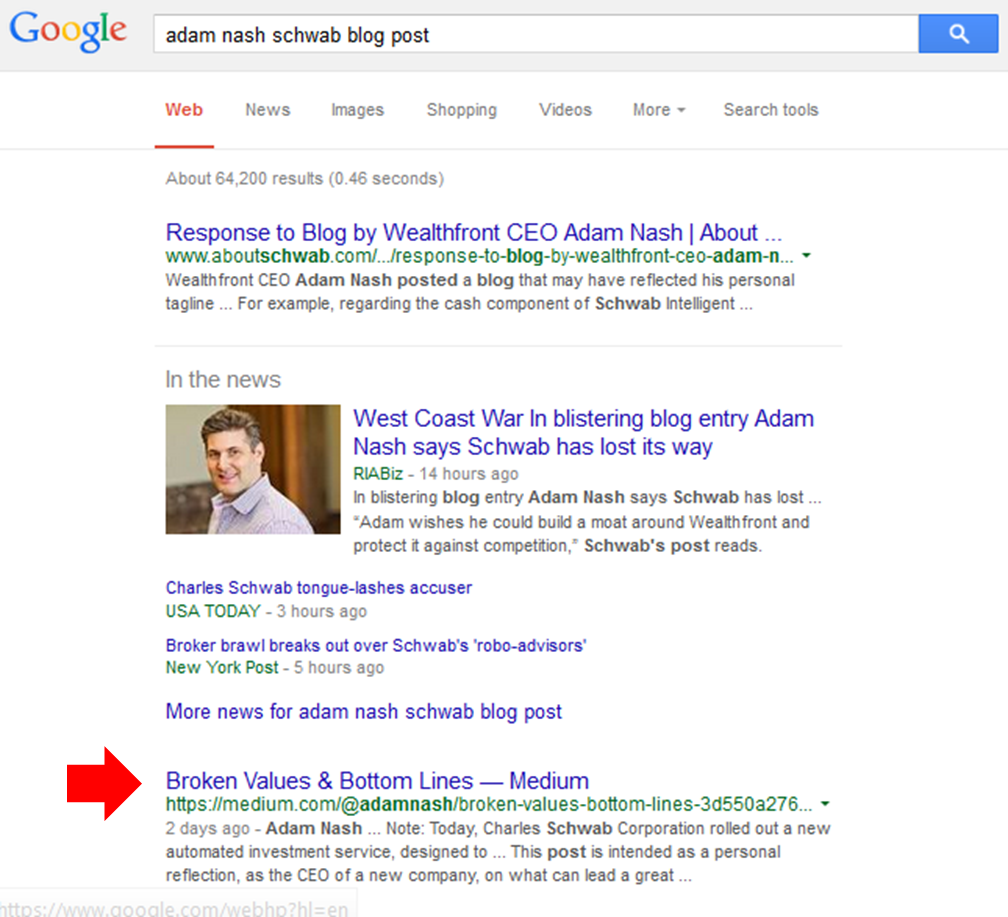

The first mention I saw of Adam Nash’s blog post was in a Schwab tweet. To read the post, I naturally headed to the Wealthfront blog—where there was no sign of what Wealthfront’s CEO said. That’s because the post was published under Nash’s byline on Medium.com.

Interesting. I assumed that a calculation was made to go where there was a larger absolute audience, probably to position the topic at a higher level than one company CEO griping about another company’s strategy. In fact, RIABiz reported that Nash’s “blog offensive is being waged on a personal level, which is why it appeared on his own blog..." Nash's blog, yes, but on another company's domain.

Understood, and maybe there were compliance issues to consider, too. But there will be those who will come to Wealthfront’s site, looking for the post, and they will be lost. Conversely, those who go to the Medium post won’t see anything else about Wealthfront’s services.

And, to make the point that any digital marketer would, the decision to use Medium results in a surrender of Wealthfront.com attention, site traffic and analytics. Links, especially from authoritative sites, still have value. And yet all the linking to Nash’s post on Medium will help lift Wealthfront’s search visibility not at all. Medium does make some viewer stats available but they’re not as robust as what Wealthfront would get from its own Google Analytics.

A Google search Wednesday for “Adam Nash Schwab blog post” required the searcher to hop over the Schwab response to Nash’s post (which doesn’t contain a link to it).

Compare the page titles and URLs used for the posts for a partial explanation of Schwab’s higher ranking—that and the fact that Google results favor better-trafficked Websites.

Schwab is unusual in that it already maintains a section of its Website for Company Statements “in response to timely news and topics of interest. Statements are generally removed from this site after one year.” This is where it chose to publish its all-text response to Nash.

A few tweets have made some generational references to the old school way in which Schwab responded—via “a press statement” that used double spaces between sentences (really!). While much of the response is straightforward, it lets itself condescend in a few spots. I wonder how much thought was given to referring to Nash as “Adam” inasmuch as the response ostensibly came from the company and not an individual.

There’s no provision for comments on the Company Statements pages, which is unfortunate given the statement's closing line: "We encourage transparency and dialogue and that is why we encourage investors to learn more at intelligent.schwab.com and review the facts."

Did Schwab consider commenting on the Medium post, as well, I wonder? As is, both firms have taken to their own corners to comment, leaving readers to their own devices in piecing the commentaries together.

Getting The Word Out

Having published their respective messages, Nash and Schwab then took to Twitter (only) to make sure the word got out. The first tweet flew from Nash’s own account but soon the Wealthfront account also was pressed into action, to drive traffic to the Medium post as well as retweet supporting tweets of which there were many.

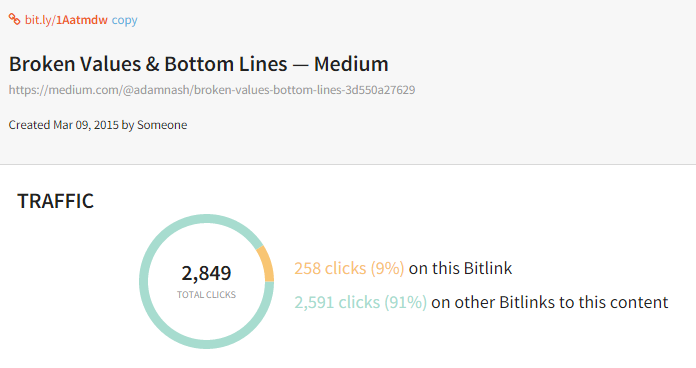

You and I don’t know the total traffic to either post. From the sharing data counted by BuzzSumo, it looks as if the sharing done of Nash’s post through Wednesday far outpaced the sharing of the one-day older Schwab rebuttal. Note that the Nash post was shared on LinkedIn and Facebook, too.

By Wednesday, Bitly reported about 2,900 clicks on bitly links to Nash’s post, and traffic to non-shortened links would be additional.

As of Wednesday, the @CharlesSchwab Twitter account (the @Schwab4RIAs account has not been involved) had not sent a mass distribution tweet with a link to its company statement. This seems to have been an effort to “contain” the discussion.

However, Schwab reached out to Twitter accounts who tweeted about the Nash post. Specifically, through Wednesday it sent 15 individually addressed tweets (tweets that start with the @accountname, limiting the reach of the tweet to only mutual followers of both accounts). You can see the tweets under the Tweets & Replies Tab of the account.

It's possible that Schwab’s original communication plan included influencer marketing, which involves brands reaching out to identified influencers with the hope that the offer of early information or special access will yield positive coverage.

But these individually addressed tweets were not that. An account that tweeted about the Nash post is not likely to be open to any kind of perceived “manipulation” on Schwab’s part, not at that point. As stated, the purpose was to make sure that the account saw Schwab’s side of the debate.

Many of the accounts tweeted to in fact belong to those influential in the space, including Josh Brown, Michael Kitces and Paul Kedrosky. The net effect of that for those who follow these influencers is that multiple identical Schwab tweets showed up in the Twitter stream. A series of Schwab tweets is what first caught my attention.

Did the target account even click on the link? Better yet, did the target account retweet it, as many might feel obliged to do if they’d previously tweeted about Nash’s post? How many clicks did each attract?

Because Schwab provided each Twitter account with a unique shortened link (bitly), bystanders can see the effect of the outreach by account. Just by adding a plus sign to each bitly, we can get a look at where the outreach worked best. Through Wednesday, it looks as if there were nearly 1,500 total clicks to the page. Two bitlys were tweeted to The @ReformedBroker (Josh Brown), and together they drove almost 900 clicks or 60% of all. The most effective tweet is shown below.

By comparison, the bitly link to the press release announcing the Intelligent Portfolios attracted 118 clicks. Of course, there's no doubt Schwab is collecting more data on its outreach than we have access to.

In Conclusion?

How to wrap this up? It can't be done, it's too soon. Can we agree to just adjourn?

Join me in watching how the substance of the debate unfolds and—particularly relevant for communicators—where and how it takes place. If nothing else, the jockeying by these two firms is demonstrating the importance of real-time listening, reacting and acting.

Maybe not on this scale or at this emotional pitch, but it’s reasonable to expect that your firm will be the subject of online discourse at some unknowable point. It’s an eventuality that cool heads, including those belonging to digital marketers, need to prepare for.