Investment Podcasts 2.0—But Let’s Promote Them This Time

/ TweetI love podcasts so much that I keep waiting for them to make a comeback in the investment industry.

Elsewhere, others have declared a podcast renaissance, driven in part by last year’s stunning 68 million-plus downloads of the Serial podcast. See this 2014 post for what else has changed too, though.

Combine fund companies’ desire to assert thought leadership with users’ heightened content consumption, including while mobile, and the argument for podcasts should be difficult to resist on both sides.

Quite a few firms tried podcasts early on and gave up, as can still be seen on dormant iTunes and Web pages. Blame it on clumsy podcast downloading requirements, less than engaging content, lack of user adoption but also—here's where you come in—a lack of promotional effort on providers’ part.

It's too soon and too spotty to call it a comeback, but there are some encouraging signs that podcasts are back on the radar.

Advisors Are Listening To Something

Advisor use of podcasts appears to have rebounded, according to data reported by American Century’s 2015 Financial Professionals Social Media Adoption Study (more on the study in last week's post).

Podcasts were among the choices provided in a general (as opposed to investment content-specific) question, “Do you have a profile or account with any of the following social media?”

One out of 10 advisors, by the way, is the same number of advisors who say they read blogs.

Promotion-wise, note the support that Goldman Sachs gives its monthly podcast “Exchanges at Goldman Sachs.” As opposed to tucking it on a modest Podcasts page buried somewhere on a Website, Goldman:

- Commits high level talent to the shows

- Gives the podcast exposure on the firm's home page

- Launches each new show with a splash on its Website and elsewhere, including where I spotted it on an interstitial ad on Stitcher, the streaming service. Goldman is buying pay-per-click ads too. And, having Business Insider cover the podcast content, which happened this week, no doubt provides a nice lift.

Yet To Happen: Consistent Discovery, Delivery

Firms that have returned to podcasting or have launched anew tend to go their own way on presentation and delivery. This is surprising given the standardization of most other fund company communications, especially those directed at a primary audience of financial advisors. Why not simplify the user experience?

The inconsistency in how podcasts get discovered and delivered may be containing overall pick-up. For example, if iTunes is the first result in a search for your firm’s podcast, you’re not doing enough on your own domain. With all due respect.

Goldman’s approach—including making the podcast available not just on iTunes but also to be streamed on Stitcher and elsewhere—represents the state of the art of podcast promotion today.

Below is a list of mutual fund and exchange-traded fund (ETF) firms publishing podcasts that I’m aware of. If I’ve missed yours, please let me know and I’ll be happy to add to the list.

- American Century

- BPV Capital Management

- Lazard

- MFS

- WisdomTree

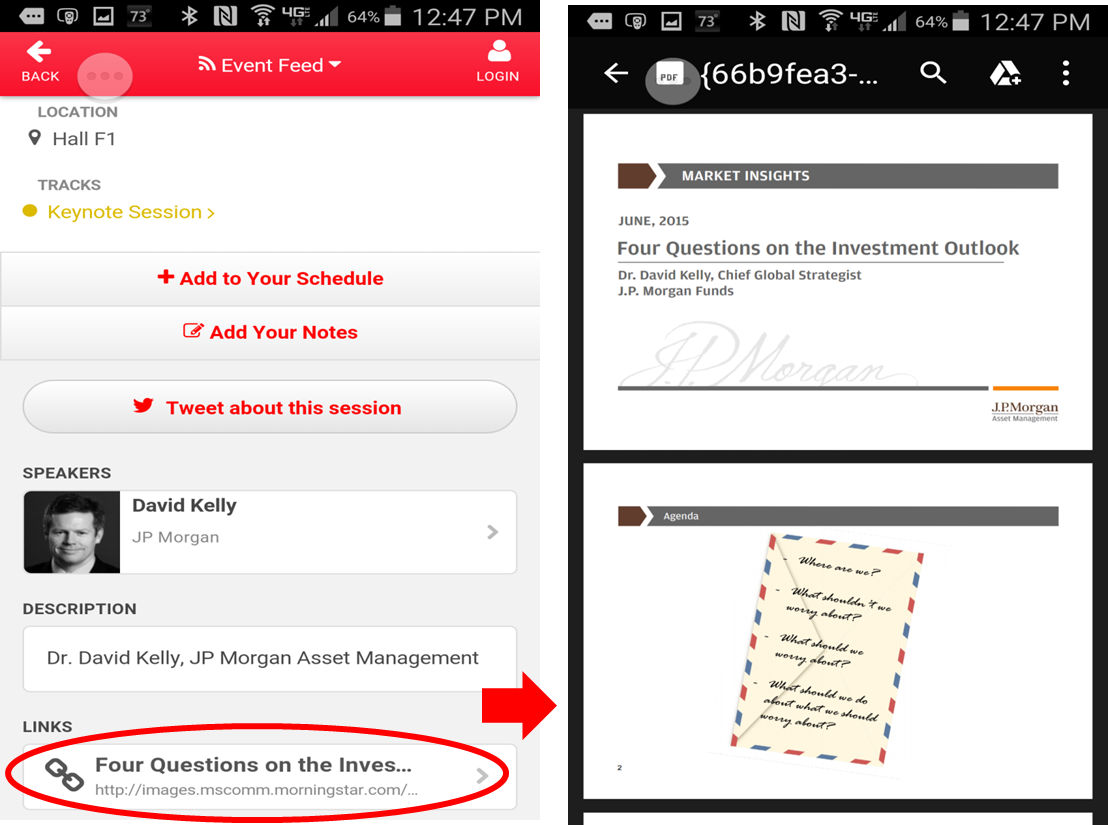

- J.P. Morgan Funds

- T. Rowe Price

- Vanguard

- Wells Fargo Advantage Funds

Also check out these related podcasts:

- Between Sessions with Blane Warrene and Jay Palter. This is an occasional Google Hangouts-produced (but available on-demand via YouTube) discussion about #fintech and #finserv.

- Bloomberg Business ETF Report with Bloomberg reporters

- ETF Gurus with Dave Nadig of FactSet. The August 26 show on the “ETF flash crash,” in particular, featured one of the most helpful discussions I’ve heard or seen.

- The ETF Store Show One of my favorite business podcasts, this is an informative and informed discussion by a Kansas City-based registered investment advisor (RIA).

- ETF Trends featuring ETF media veteran and publisher Tom Lydon.

- FP Pad This is one of the many media properties of financial advisor technology expert Bill Winterberg; asset management marketers can learn from Bill.

- Hearsay Social On the Air The social media archiving solution provider just celebrated its one-year anniversary providing financial social media content.

- Morningstar A video and audio podcast are available.