How J.P. Morgan Serves Up The ‘Next Best Content’

/ TweetJ.P. Morgan Asset Management has a well deserved reputation for its content prowess, including the Quarterly Guide to the Markets and its many iterations.

Thanks to a vendor-organized Webinar last week, we now have a better idea of the thinking behind the digital experience that the content is used to support.

Below is a screenshot of the 58-minute “Asset Management: The Digital Transformation” presentation featuring idio CEO Ed Barrow and J.P. Morgan’s Global Head of Digital Experience Tom Libretto. It’s not embeddable so you’d have to click on the image or this link to go to the idio page and watch.

Before you do, I’ll share a few of my notes.

The first 20 or so minutes from Barrow are broad and bounce around a bit. Some of his comments and generalizations throughout may test your patience. (Example: “Clients no longer trust past performance and Morningstar ratings to make investment decisions.”) And, there are more than a few idio product plugs. But hang in there for Libretto’s insights.

Too Much Content?

In the asset management industry overall, Libretto said, “The reality is that we don’t need to produce as much content as we do. We need to understand more and more what types of content, in which formats, wrapped around what type of context, are going to compel a client to engage and take the next step with us.”

Content Planning

At J.P. Morgan, “before there’s heavy investment in content production, we do the due diligence to determine what the objectives of the content need to be or are, and how the content will or won’t be promoted,” he said.

Editorial meetings include regular discussions akin to television programming (e.g., “how many slots do you have to fill?”). That forms the basis for an editorial calendar view of what’s available, identification of formats and syndication opportunities across distribution channels.

Libretto repeated Barrow’s use of the word “surgical” to characterize how the team determines which formats—including “word counts, font sizes, graphical cues or peeks of content—are capable of driving interest. All of those things are part of the content continuum as we convert from raw material into a digital experience.”

“Emotional conversations” about what content gets produced are avoided by use of a scoring system, according to Libretto. “So,” he said, “when something hits a threshold and we all feel it’s compelling enough to promote, we have the resources to promote that output”—which they do across a multitude of paid and content syndication distribution points.

Data Leads To Content Intelligence

Most fascinating was how J.P. Morgan is merging, cleansing and aggregating its estimated 45 to 50 data sources, as well as buying third-party data, for the purpose of modeling the role that content plays.

In addition to the legacy nature of some systems and system redundancy, the sheer volume of data is a challenge. Libretto’s approach is aimed at determining which types of interactions—face-to-face meeting, Web visit, app open, transaction, etc.—matter and which don’t. Sequence is a focus, too.

To be able to isolate and correlate interactions that are leading indicators to a near-term business transaction provides “a much, much smaller, tighter set of interactions to optimize your strategies around. You can almost discount the others [he estimated that about 90% of the data could be ignored] or use them for other purposes to enhance the client journey,” Libretto said.

The idio solution is one of the tools that J.P. Morgan has begun to use to provide 1)contextual relevance for the content consumer and 2)real-time actionable insight for the firm.

idio’s contribution is on what can be learned from the content being consumed by a visitor to the J.P. Morgan domain. Topic interests are gleaned from the various content pieces accessed, and referred to for the purpose of building a profile that seeks to understand the visitor’s challenges and predict in real-time the next content to offer.

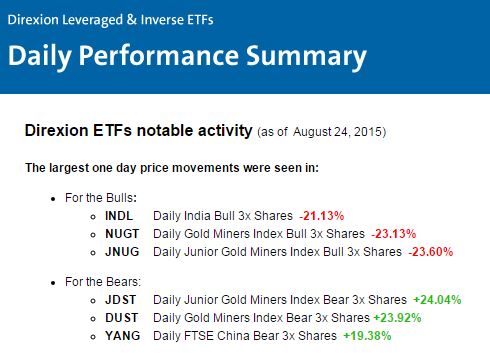

The slide above provides a look at how previous content and conversions drive “next best” content or action recommendations, although few specifics were given.

idio provides a "data source on which to fire a variety of next step actions, whether it be dynamic content rendering of the next piece of Web content or firing an alert to a salesperson that we have high conviction that somebody who just read something—in combination with other interactions we’ve seen come through over the last n periods—means that a meeting should be queued up sooner or later," Libretto explained.