Really? LinkedIn Groups Are Asset Managers’ Most Important Social Media Offering?

/ TweetAmerican Century Investments yesterday released an update to last year’s widely quoted survey on advisor adoption and use of social media.

Overall, the 2012 survey reflects progress that’s along the lines of what we all have been seeing:

- Nine out of 10 advisors now have a social media profile or account—73% Facebook (vs. 71% in 2011), 62% LinkedIn (vs. 55% in 2011) and 27% Twitter (vs. 19% in 2011).

- More advisors are active—56% (vs. 51% in 2011) say they’re either moderate or extensive social media users.

- Access via a mobile device, which is the headline of the American Century announcement, has more than doubled.

- And, something that will please Google, 19% of advisors created Google+ accounts in the nine months that social network has been live.

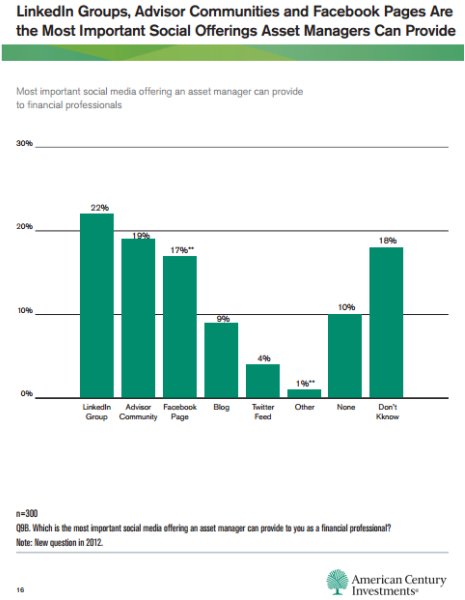

But there is one finding that’s quite surprising. When asked “Which is the most important social media offering an asset manager can provide to you as a financial professional?”, advisors prioritized LinkedIn Groups, Advisor Communities and Facebook Pages higher than a blog or Twitter feed. If I were asked to rank these, I have to say that this is almost the reverse order that I might assign in terms of their specific usefulness to advisors.

And, this doesn’t quite jibe with what 60% of social media-using advisors say they want from asset managers, which is commentary and market insights. LinkedIn Groups and communities are supposed to be more about interaction than about commentary and market insights. There are other ways for asset managers to push, and for advisors to receive commentary and insights than via asset manager LinkedIn groups.

A Strong Showing For “Don’t Know”

In a telephone conversation yesterday afternoon, Jennifer Sussman, Director of Digital Engagement for American Century, took it in stride when I told her I was skeptical about the LinkedIn group top ranking.

For their part, she said, American Century was surprised that Facebook pages came in second as an answer to the question.

"We have never looked at Facebook as an advisor medium," Sussman said. "When you’re on Facebook, you’re there for personal entertainment. As much as we love what we do, I don’t think personal entertainment is the class that we live in," she said, laughing.

Yep, I question that, too. Seventeen percent of those surveyed said Facebook pages are the most important offering an asset manager can provide. Elsewhere, the study says that 2% of the advisors surveyed use Facebook for business use only and 18% use Facebook for business and personal. That would mean that of the total 20% of advisors who use Facebook for business, all but 3% believe prioritize Facebook pages from asset managers above all else.

Maybe the advisors just recognized LinkedIn and Facebook as the social sites they used the most, Sussman offered.

Or, perhaps it’s most telling, she said, that 18% of advisors said they “didn’t know” the most important thing asset managers could do for them in social media.

I agree with that. What advisors know for certain is what they’re up to, and the rest of the American Century research lays out what advisors are doing and thinking about their own level of social media participation. But, as the late Apple CEO Steve Jobs famously said, “Customers cannot tell you what they need.”

From What We Can See

Many asset managers have already considered the effort required to commit to building a LinkedIn group and decided against it. I wouldn’t let the 22% of 300 advisors surveyed change your minds about that.

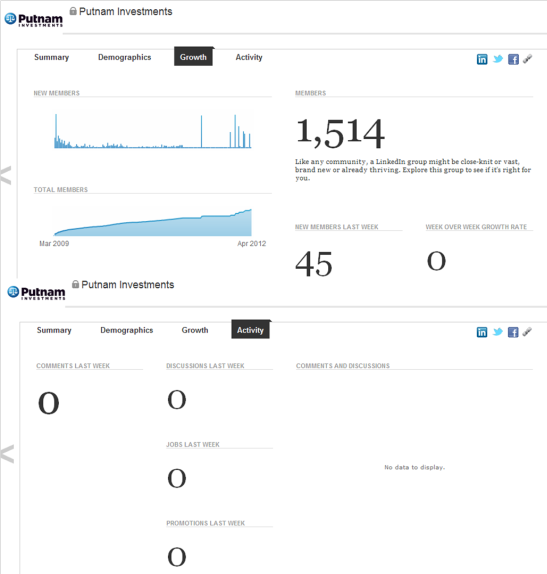

Among the largest firms, I count five existing LinkedIn investment management discussion groups belonging to Black Rock, Fidelity, iShares, MFS and Putnam. And, after I published this post, I was reminded of a sixth—Balanced Advisor Sponsored by Janus Labs. (Many other asset managers have LinkedIn groups but for alumni.) From what we can all see from the group statistics available on each LinkedIn group page, I have my doubts that the return on starting a new group today would justify the work involved.

Asset manager LinkedIn Group membership is on the rise, likely in line with LinkedIn membership and growing awareness of LinkedIn among advisors. But engagement in terms of relevant discussions or comments is at a low level in the asset managers' closed groups (Putnam and MFS). In the best cases, many of the discussions are started by the asset manager admin of the group. In groups that are open communities (Fidelity, BlackRock, iShares), self-promotional spam appears to be overwhelming the group’s intent.

It’s dangerous business to dismiss survey findings just because they’re surprising. So, what could explain advisors’ high LinkedIn Group ranking? A few possibilities, I suppose:

- That there are some asset managers running popular groups that don’t bear their names and therefore can’t be found via LinkedIn Search.

- That there are some closed asset manager LinkedIn groups that are hidden from the directory search and otherwise not visible to the rest of us but providing high value to the advisors who belong to them. …And that this research found those advisors active in the closed groups.

- That advisors are taking in the asset manager content posted to the LinkedIn groups and clicking through to asset managers’ sites, producing site traffic/benefit the rest of us can’t see. However, for whatever reason (Compliance? Shyness?), group members are not entering into conversations in the groups. If this possibility is true, these must be different advisors than join some of the truly active advisor-focused LinkedIn groups.

Just A Head Fake?

I lean toward the possibility that this answer is nothing more than a head fake, which is what you're going to get every once in a while in a quickly evolving space.

As solid as it may be in providing a snapshot of social media usage, one survey isn’t going to serve as a substitute for the work you and your firm need to do to fully consider the social activities your clients will respond to. I may have belabored the point here because the 2011 American Century survey had such traction last year and I'd hate to think that the answers to this question would be institutionalized without a certain amount of critical thinking. Thriving in ambiguity requires self-sufficiency.

What are your thoughts on this and other insights from the latest research? Do you know of an asset manager who's managing an effective advisor-focused LinkedIn Group strategy? Please—let us know below.