3 Views On The Asset Management Industry And Its Future

/ TweetTomorrow the people decide the future of the United States—and we can all rest assured that there will be ample interpretation of the Election Day results.

Today and closer to home, I want to share some content that’s been published recently about the future of the asset management industry and its challenges.

Study after study points to the bright future for digital marketing at mutual fund and exchange-traded fund (ETF) firms. You my dear digital marketing peeps are all good. But, what about your firm as a whole and the industry you’re in? The more you think about the business’ challenges, the greater the contribution you can make. It’s in that spirit that I offer the following.

McKinsey: Solution Delivery Faces Capability, Credibility Challenges

“Firms often under-invest in understanding client needs (especially in retail) and packaging them in a way that resonates with consumers and their advisors. As a result, there are hundreds of failed 'me-too' products, myriad 'solutions' in search of an ill-defined problem, and many great products that fail to be understood (and bought) by consumers.”

Ouch! This is a direct hit from a McKinsey report published last week that it wouldn’t kill you to download and read in full.

The report’s headline “The Asset Management Industry: Outcomes Are the New Alpha” hints at the key takeaway for marketers. While many asset manager product communications continue to dwell on relative performance claims (beating benchmarks and snagging Lipper rankings/Morningstar ratings), McKinsey says investment performance advantages explain just about one-third of the net new flows in the last decade.

McKinsey acknowledges that the industry has begun to shift from selling performance to investment outcomes (e.g., income generation and principal protection) via solutions (e.g., inflation-linked strategies, target volatility products that offer downside protection, “go-anywhere” funds, etc.).

No doubt you’re hearing plenty about solutions. According to a McKinsey survey, 80% of firms list solutions as a top three growth priority, and the average firm expects solutions to account for more than 25% of flows and 15% of profits by 2015.

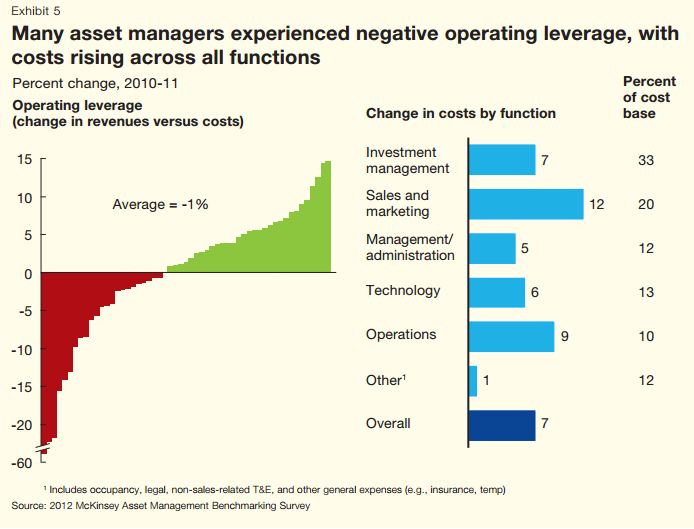

But while many of the new products are in place, McKinsey says firms “face capability and credibility challenges” in their efforts to deliver the solutions effectively. Also see McKinsey’s data suggesting that expenses for the functions charged with delivery—Sales and Marketing—rose the most in 2011.

When, as McKinsey says, "the most lucrative industry in the financial services sector has been virtually incapable of collecting new money from its clients," it's safe to assume that change is in the air.

At the FundForum: Differentiation, Complexity, Regulation

What are the biggest challenges facing the U.S. investment management industry? You’ll see some of the same themes of the McKinsey report in this 4:52 video of people intercepted at the FundForum U.S. 2012 conference last month. It’s a blend of comments from people who answered the question from the perspective of providers and from the perspective of investors.

From ALFI: Regulation, Product Complexity, Financial Advice

This next video is brought to us by ALFI, the Association of the Luxembourg Fund Industry. I include these comments from NICSA President Theresa Hamacher not for their nod to social media but for the overview they provide about five trends shaping the industry. Effective delivery of the investment solutions your firms are pivoting to will require alignment with how financial advisors are positioning themselves with their clients, and Hamacher touches on that.