Yes, But...How Fund Marketing Is Evolving

/ TweetThere’s a striking evolution underway of investment product marketing/communications. You may need to use a machete to find it, cutting through all the market insights, retirement and personal finance updates that overwhelm asset manager content streams. But look at just the product-supporting communications that are being created using modern-day publishing tools and you'll see what I mean.

There’s no question that we were due for a change, as I was reminded of Sunday via a tweet that I was cced on (yes, that’s a thing).

Tom Brakke aka @researchpuzzler lifted a “fund marketing flowchart” from a partial book draft written in 2000 by Clifford Asness, founder of AQR. Asness described the chart as a decision-making model.

Now, I might have been tempted to dismiss this as nothing more than nostalgic. But three accounts retweeted this Sunday morning tweet, six accounts favorited it and one account piled on. @MikeCraft6, a self-described “bond fanatic,” suggested that a fourth box be added: "Merge Fund into One of the Above."

I don’t know for sure that Brakke—an investment advisor and consultant respected for his views on investment management process and communications; I’ve mentioned him before—meant to bait me. But I took the tweet and the response to heart.

Fund performance advertising has been hated since well before the year 2000. It’s easy to understand why. The basis of the derision is that performance records aren’t something anybody can safely use. As has been repeatedly documented, too often investors felt suckered into “hot funds”—what we advertised. Craft’s add-on jab about merging funds just underscores that “fund marketing” has a trust problem that continues today.

Fund Marketing > Performance Advertising

We did more than performance advertising 15 years ago, but I’ll concede that performance advertising may have been the most outward sign of fund marketing dollars at work. Advertising space purchased to showcase a table of index-beating returns was a concise presentation. The results were offered as a shortcut for what there wasn’t room to say about how those results were produced. Good numbers were enough to get everybody's attention.

The top performers were the funds advertised, absolutely. This is a point that Asness said he had no issue with. “There is hardly a business in the world that insists on pushing its ugly tough-to-sell products as hard as its attractive ones,” he wrote in his book draft.

“Furthermore, if investors insist on shunning anything doing poorly recently, and buying only recent winners, it would be very unfair to blame only the fund companies for the selective advertising practices I discuss. They should not be required to tilt at windmills.”

Excellent, we’re off the hook with the man who created the flowchart in 2000. But it’s obvious—not just in this week’s tweets but elsewhere, including Brakke’s comments on this blog in December—that marketers need to do more than promote performance in order to build trust in mutual fund and exchange-traded fund (ETF) communications.

Unbounded by the constraints that limited Marketing's ability to communicate previously (i.e., explicit budget, production/delivery time and expense, and physical space to accommodate the message), today’s product communications are extending in many new directions.

Fund marketing is more than the one-trick pony that some may still see. Yes, space is still being purchased and top-performing funds are still being advertised. But the URLs and social icons included on the ads? They lead to a wealth of additional information that should foster smarter investment decision-making—hopefully resulting in fewer of those gotchas that sting advisors and investors.

As a test Sunday through Wednesday of this week, I sifted through the tweets sent by asset managers (as tracked by the Investment Managers Twitter list) and followed the links to just the product communications. This sample of this week alone suggests a bit of what’s changed since performance advertising defined fund marketing 15 years ago and more.

Going Direct

Access to their own publishing platforms enables firms to go direct, overcoming the budget and finite space limitations of using a media partner to reach advisors/investors. A regularly updated blog combined with social network updates provides for relevant, time-sensitive and friction-free communicating about much more than performance.

For example, here’s AdvisorShares, which weekly takes it upon itself to report on the active ETF market share, including tables of outflow and inflow data showing other firms’ funds.

And, of course, fund companies aren’t the only ones practicing their new publishing skills.

In the office today, marketers continue to sweat over the display and use of brand assets. Meanwhile, there’s a whole community online that’s also newly empowered to share their own text and graphic commentary about your products in the open on the Web.

While short-term performance consumes a significant amount of the attention of those posting to Seeking Alpha or StockTwits, other attributes are discussed as well. Below is a tweet with a screenshot that shows the changes in an ETF’s assets under management. For those paying attention, these product tweets provide insights on what's interesting to others about your products.

Multi-threaded

Previously, fewer than a handful of funds received extra marketing support. Those were the funds whose impressive performance made it easy for wholesalers to engage advisors. It was a backward-looking approach, no question.

But today's product-focused blogs support multiple products. It’s the rare firm that hammers home one fund and ignores all others.

In addition to aiding investor understanding, this multi-threaded support serves at least two purposes for a firm:

- It showcases the thinking of all the teams. The “global breadth and depth” of the firm is made real with posts from a blogging stable that includes portfolio managers, portfolio strategists, investment and research analysts.

- A continuous (vs. sporadic) focus assures a ready supply of content, which will help when the market rotates and there’s heightened interest.

Check out Franklin Templeton’s Fixed Income Almanac, a new "one-stop shop" for portfolio manager perspective and historical data.

Back in the day, portfolio management had a top-down, locked down approach to being available to Marketing. As a former shareholder report-writer, I sometimes wondered whether the goal was to reveal as little as possible.

This kind of thing from Motley Fool Funds just wasn’t happening in 2000.

From Advisor-Only To ‘Please Share’

Content-sharing isn’t a new concept to fund marketers. But the party line has changed quite a bit. Having thrown in the towel on keeping advisors from sharing product content with their clients (more can be said when the content is prepared for licensed professionals), marketers now are motivated to create shareworthy information.

With this enlightenment comes the recognition that it’s a short list of people who are going to share your product performance data with their social networks. Performance is only one attribute of an investment product and maybe even the least differentiating. There’s also the fund’s story including its process and its holdings, its portfolio management (often featured in old tyme advertising but in a more distant way), its role in a portfolio, its expenses (the focus of many ETF communications).

The qualitative information that’s provided via these product communications is something that robo-advisors aren't able to factor into their algorithms.

Where previously we would have relegated a risk discussion to the smallest typeface at the bottom of a printed page, check out WisdomTree's 800 words on risk.

The post comes to a favorable conclusion regarding the index underlying the EPI ETF. But does that mean that this content is little more than self-serving?

If we were talking about those posts that begin with, “Is it time to consider (insert product category here)?” I’d have to agree, yes. Not a fan. But WisdomTree's elaboration leads to a more informed buyer of its ETF after a run-up.

And then there's this Rochester Funds tweet about Puerto Rico sales tax collections. It’s a narrow, product-related update that couldn’t have been effectively distributed, and wouldn't have commanded any marketing support, in the old world.

Storytelling possibilities expanded with the rise of ETFs and specifically slice-of-the-market ETFs. A story is much easier to engage with than past performance.

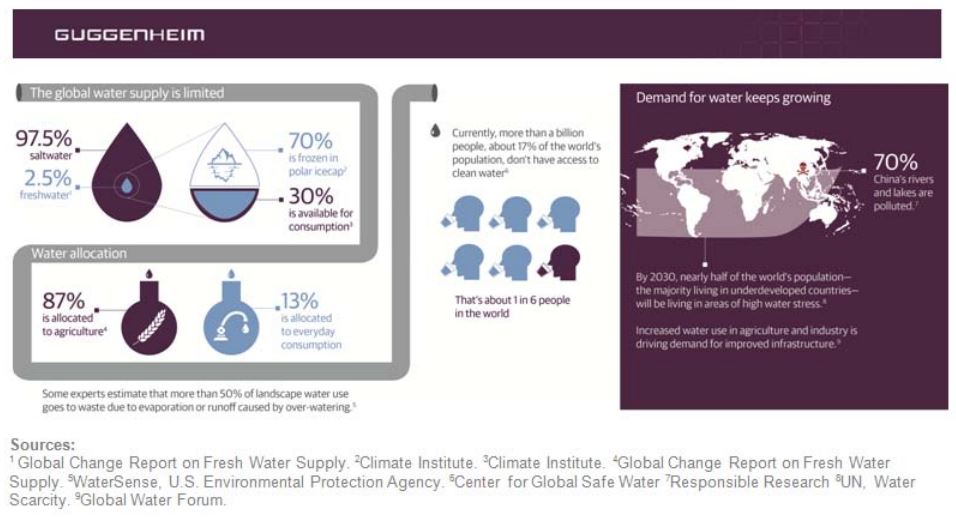

See this infographic on the global water supply, which Guggenheim distributed along with its press releasecommemorating World Water Day 2015. Guggenheim started with why and then closed by focusing on water “as an attractive investment opportunity” and its global water ETF CGW.

Sometimes—as happens often with PureFunds’ tweets—the connection between the story (another cyber hack) and the solution (the cyber security ETF HACK) is short and sweet. This series of tweets represent a whole different interpretation of drip marketing.

It Takes A Village, Not A Family

The presentation of products on fund company Websites has improved immeasurably in the last 15 years.

But for this post on product marketing, there’s one change worth mentioning: The opening up of fund comparison tools to include all products. It really wasn’t so long ago that these tools were limited to building portfolios with just the Website sponsor’s products, the so-called family of funds. I believe that Putnam deserves credit for blowing that model up, and most if not all firms have followed the lead.

This represents a shift in understanding toward a practical emphasis on how the products can be used. In isolation, past performance helps not very much. Over the years, marketers have learned that fund providers should help with how their products work with others' products.

Content-wise this week, Nuveen offered almost 12 minutes on to how to use small caps in a portfolio and Ivy Funds commented on using a commodities allocation. Wells Fargo Advantage Funds launched a month-long series on using alternatives.

If you’ve been on the inside these last several years, the changes occurring aren’t news to you. The social launches, the video production, the whitepaper manufacturing all have added both to the workload and the expectations of fund marketing. And, you have the best understanding of how much more there is to do.

Will this work serve to bolster trust among those unimpressed by the attention given hot products? I believe it will, with more, and more relevant, communicating yet to come. As always, your thoughts are welcome below.

A few of the examples above are from firms that I have worked for or currently work for. To exclude them from a round-up post would be to penalize my clients. However, I was not involved in/compensated for anything cited above. When I refer to something that I’ve done for a client, I disclose it.