Why Facebook’s New Search May Prompt A Review Of What You’re Posting There

/ TweetFacebook, the behemoth social network known for being a “walled garden,” has been an object of mystery and curiosity.

It’s easy to understand its appeal to financial advisors as a friction-free way to communicate with clients. And, most of those interactions may be none of the mutual fund or exchange-traded fund (ETF) marketer’s business.

But Facebook is also an estimable platform for discovering and passing along content—investment-related content included. (See this post for an analysis of the level of financial services content currently being shared, and the dominant brands.)

Financial advisors use content as their social currency. Putnam’s latest social media research reported that Facebook plays a “very significant role in current marketing efforts” for four out of 10 advisors (see post). Almost three-quarters (73%) said they posted business content to Facebook.

Exactly what content is being posted and shared, and by whom? Each Facebook account sees its own feed, of course, but to date there has been no view into the content collection. Those garden walls were too high to peer over.

Facebook’s decision last week to make all of its 2 trillion public posts available via a tabbed search capability changes that. It instantly makes Facebook a whole lot more interesting for the search-aware content marketer.

With billing no less than "find what the world is saying," Facebook Search FYI is a new, rich resource to become familiar with.

I’ve previously mentioned the value I get out of Twitter’s Advanced Search, in part because it enables a filtering of tweets only “from people you know.” The new Facebook search one-ups that.

A Facebook search will now produce a results page personalized based on 200 factors including what you like and engage with, what you’ve searched for, and information they've collected about your identity. The Top tab (which is the default) produces the most relevant results for the account.

According to a TechCrunch post, the results are organized “to highlight posts from trusted news sources, followed by people in your network, lists of the most popular links or quotes about a topic, and then strangers.” The images below were prepared by Facebook to illustrate the search results on a smartphone.

Here's a quick review of where I see the added value.

Listening And Learning

Now you can plug into what’s being said on Facebook, and what you learn can influence your content positioning and development, including search engine optimization and pay-per-click keyword planning.

Example: Facebook claims to process 1.5 billion searches a day (that's about half of what Google handles) and that’s the basis for its assisted search. When I typed in the most generic of terms—“mutual funds”—Facebook reveals that “mutual funds vs” is a frequently searched term. Hmm...

The Latest tab is where Facebook takes Twitter head on. Twitter has been the go-to source for tracking what people are talking about right now, and that is what’s now delivered in the Latest tab. I find these results much less relevant on broad terms. Hashtag searches can get you to what you want to see, but keep reading.

For Demonstrating Topic Relevance

Previously, posting to Facebook truly has been like dropping a teaspoon of matter down a black hole—good luck to anyone ever finding it. In fact, the joke’s been made that even those who aren’t diligent about their privacy settings have enjoyed "privacy through obscurity."

(This Search changes that and if you don’t want your own past posts showing up in search results, head on over to Facebook's Settings/Privacy/Privacy Settings and Tools.)

Assuming content-sharers make use of the new functionality and financial advisors in particular come to rely on it too, Facebook could be a powerful place to post on a fast-breaking topic and be noticed.

For asset management marketers, this may prompt a review of what’s being posted to Facebook.

Not Just The Soft Side Of What You Do

It’s a best practice to select content appropriate for each social network, and Facebook has tended to attract asset managers’ soft-side community posts. But things change.

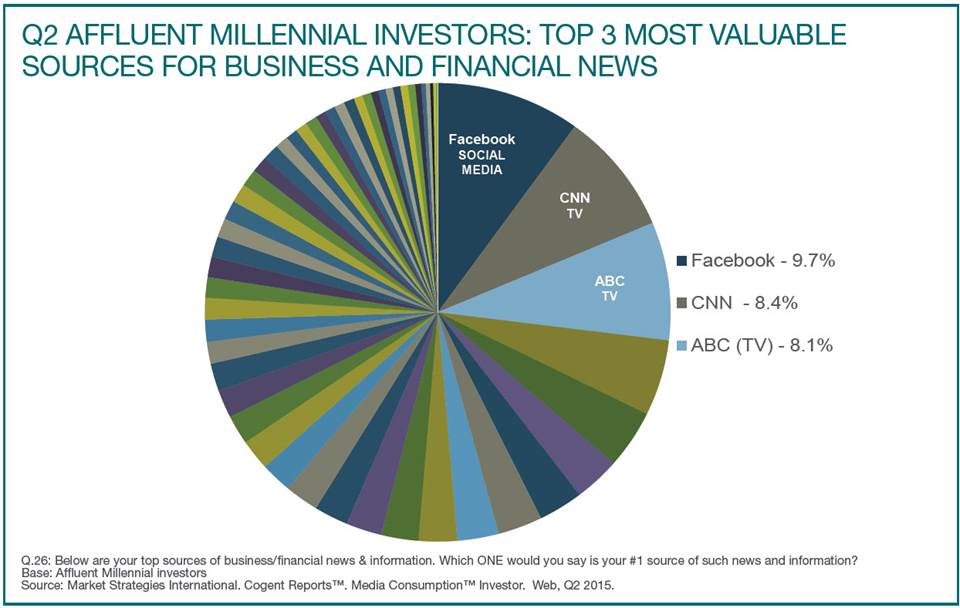

For example, Cogent Reports reported in August that Facebook is the top business and financial news source for millennials.

If users begin to rely on the Latest tab to search for investment-related updates, you are going to want your firm to be represented.

But here’s the hitch I found in limited testing this week. I maintain a custom list of Asset Managers’ Facebook pages, which is a signal to Facebook that your content is important to me. While my keyword searches surfaced mutual fund/ETF firms’ updates in my Top tab (personalized to me), I don’t see your updates in the Latest tab.

For example, my search for #ETF produced this AdvisorShares post, along with posts from Scottrade, Investopedia and Wyatt Investment Research, in the Top feed.

None of those posts from "Financial Planning" or "Business/Economy" Websites appear in the Latest tab search results, however. Do a search for #ETFs and you’ll see a collection of unrelated updates about tattoos and such—not relevant, not helpful.

As a second example, a hashtag search of #BudgetDeal is a timely topic that asset managers might have produced content on and may even be tweeting about. In fact, I saw a few posts from Allianz's Mohamed El-Erian.

But overall the #BudgetDeal discussion on Facebook is being dominated by what I'll call posters representing the fringe—it and the discussion of other investment topics could use the contribution of mainstream investment firms’ and Main Street financial advisors.

As has been well documented, Facebook is notorious for trimming the free publishing capabilities of brands. They have no intention of giving away what they could charge businesses for.

You could achieve your objective to get in the Latest tab feed if you could post updates from an individual’s (strategist or portfolio manager) account. This Kevin O'Leary (O'Shares ETFs founder and Shark Tank host) post from August appeared in a Latest search for #ETFs, for example.

But wrangling to get access to an individual's Facebook account may be a whole ‘nother hornet’s nest—see this post for a discussion of related issues.

If brand content won't appear in the Latest tab, the opportunity for content discovery via Search shrinks. Even then, though, the option may be to resume "Follow us on Facebook" campaigns to assure that your firm has a place in followers' Top tabs.

An Opportunity For Investment Videos?

As I mentioned last week, investors say they’re being influenced by videos but whose videos and how are they being discovered? In the testing I did, there seems to be ample opportunity for asset manager or financial advisor content to surface on investment term searches in the Videos Search tab. Evidently, the Videos tab doesn't filter brand content.

For example, I searched for "rising interest rates" via the Videos tab. It was good to see a month-old Franklin Templeton video show up on top. Now that’s more like it!

Check out Facebook Search and see what you think the potential is.