How Social Media Is Influencing Institutional Investor Investment Decisions

/ TweetIf your mutual fund or exchange-traded fund (ETF) firm markets to institutional investors, you’ll want to check out social media survey results that “astounded” the research firm and “awed” an asset management marketer. Social media, the data suggests, is making a difference not only in how institutional investors source information but in the subsequent action they take, too.

In November and December 2014, Greenwich Associates, working with LinkedIn, fielded an online survey of 256 global institutional investors including 100 in North America, 105 in Europe and 51 in the Asia Pacific. The survey targeted decision-makers and influencers of investment decisions at their institution (top three titles: chief investment officer, portfolio manager, investment analyst) who used digital platforms at least once in the past year to learn about financial topics related to their investing role.

The global cut of the results was the focus of a LinkedIn Marketing Solutions Webcast last week, whose replay you can listen to below. In addition to Greenwich and LinkedIn presenters, Legg Mason’s Director and Head of Global Web Services Kerry Ryan presented best practices and results to date of some LinkedIn success using sponsored update campaigns to target institutional investors.

A report on the Europe-only survey data is due this week, with a report on the North America results scheduled to be released next month. Expect there to be some differences from the global cut, according to the presenters.

LinkedIn, Facebook And Twitter

Most surprising to Greenwich’s Managing Director Dan Connell and Ryan was that one-third of investors surveyed said they’d taken information learned via social media to start a discussion with or choose to work with a particular asset management firm. This is the first work to document this, I'm fairly certain, and the research may open many eyes.

As he reviewed the results, Connell seemed delighted to report that LinkedIn scored as the preferred social media source, with 48% of all institutional investors using the platform. The first slide showing the usage of the social networks even grays out all but LinkedIn.

In my opinion, such parochialism—and as interesting as it was, the inclusion of a happy LinkedIn advertiser as part of the program—devalues the independence of the research. The work also includes useful insights on investors’ reliance on Facebook, Twitter and YouTube, and can serve a higher purpose than just to support interest in LinkedIn. The following is a screenshot of one of the slides, with annotations added by me.

One surprise not discussed, for example: Almost half of institutional investors (47%) say they use Facebook to learn about investment products/services. This is slightly higher than those who use LinkedIn for that purpose (45%). The finding is at odds, by the way, with what ShareThis reported about the finance content that gets shared on Facebook.

Notwithstanding the cheerleading for LinkedIn, the full 56-minute presentation is worth your attention. Here are just a few highlights to pique your interest and prompt you to hit the play button.

- Nearly all (97%) institutional investors use digital media sources for professional purposes and 79% use social media at work. That's a dramatic change in the last five years, Connell noted.

- Institutional investors are turning to social media for insights, opinions and content relevant to their investing roles. And, those insights are influencing decision-making.

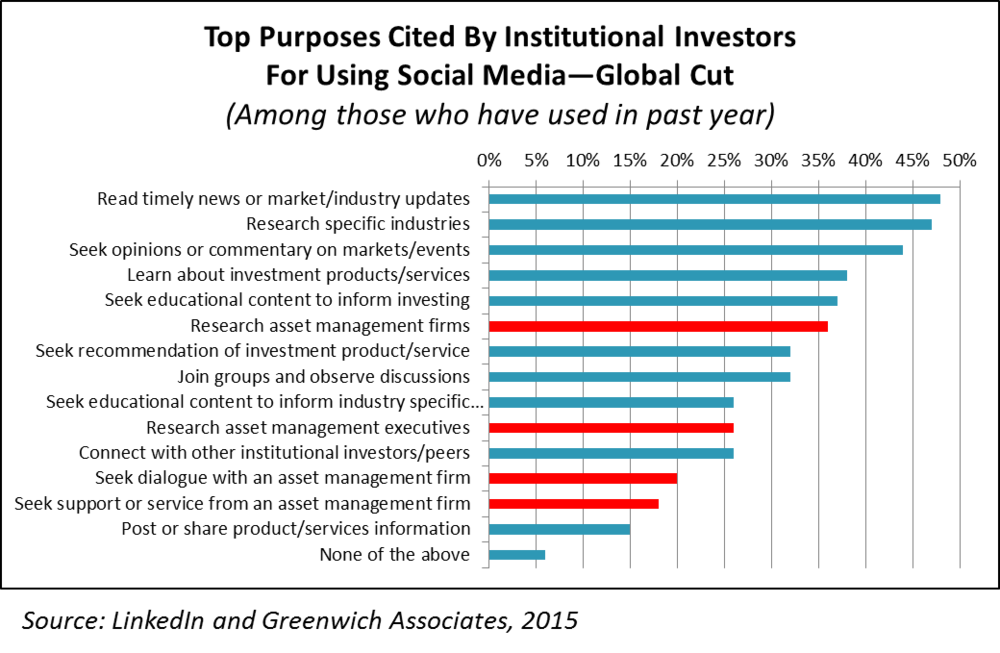

- The survey provides four answers related to investors’ interest in asset management firm content and executives specifically, and other answers related to investment product and services are relevant, too. Are you working with executives who are dragging their heels about whether they need to have a social media (probably LinkedIn) presence? Data in this table, which I created to highlight the asset management questions, might be helpful.

- Legg Mason’s 22 sponsored updates have produced an overall 0.48% clickthrough rate and 0.54% engagement rate. Since the start of the year, the company page has attracted 346 new followers.