Are You Planning For Text Alerts And Push Notifications?

/ TweetAs long as you can overlook a little rah-rah for the email channel, you might want to check out the 2012 Channel Preference Survey, a 36-page research report published last week by email provider ExactTarget.

It offers a good discussion of what ExactTarget identifies as the six factors that frame consumer preferences for a channel:

- Content

- Immediacy

- Accessibility

- Privacy

- Formality

- Initiation (the channel where the consumer initiated communication, a factor that ExactTarget says has the power to trump the other factors)

15% Prefer Text Financial Alerts

And, the report goes on to provide research on which channels consumers prefer for various types of communications.

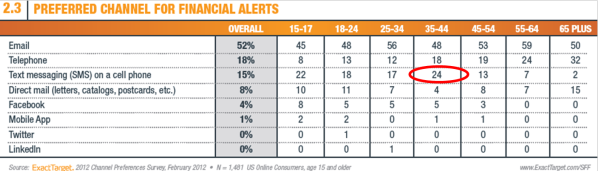

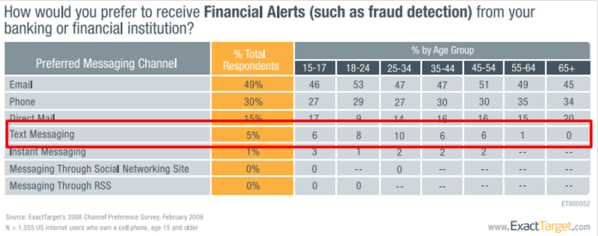

Most relevant to financial services marketers is the change in attitude toward receiving financial alerts via SMS or text messaging. From 5% in 2008, 15% of consumers now would prefer to receive financial alerts via SMS over any other channel. Nearly one out of every four Gen Xers say they’d prefer financial alerts by text. That's up from just 6% four years ago. (But see how Gen Y in 2012 likes its financial alerts by email, even more so than the general population.)

2012 Preferred Channels For Financial Alerts

2008 Preferred Channels For Financial Alerts

The majority of "financial alerts" via text are banking alerts. In a quick spot-check of asset manager sites, it looks as if only the brokerage units of Fidelity and T. Rowe Price offer text alerts. Most of them are transaction-related, but note that Fidelity’s long menu of options includes investment commentary and fund event items, too.

Hmm. It’s bad enough to see asset manager tweets announcing the availability of a fund shareholder report (sadly, a few are doing that). I can’t imagine receiving a text to that effect. But a text that a favorite money manager was about to appear on CNBC? That could make sense and would be better delivered via text than email.

And that’s the point of this ExactTarget work—the synching up of granular communications to appropriate channels, now that we have this plentiful array.

Push Notifications That Aren’t Too Pushy

The other piece of the survey that interested me was its inclusion of push notifications on mobile apps. Only 2% of the very youngest consumers prefer them for financial alerts.

On Day 1 with my first-generation iPad two years ago, a sound notification scared the heck out of me and ever since I’d made a point of systematically turning all app notifications off. But slowly, I’ve been allowing some on my phone and iPad: Chicago Blackhawks scores, flash sales announcements from a nearby store, my Stitcher app pushed me the random breaking news that Whitney Houston died.

I’m warming to notifications because the ones I allow help me in a better way than any other channel does. And, I make a distinction between the type of notification I'll tolerate on my phone (where they're always intrusive) versus on the iPad. Based on this focus group of one, I wonder if the next few years will bring the same kind of adoption reported this year with SMS.

Of all of the asset manager iPad apps that I’ve downloaded (see a recent review), only Legg Mason and T. Rowe Price appear to be using notifications today. Here, too, I think notifications can be used for good, as a way for an app to reach out to the user and subtly call attention to itself and its new content. Last year, Localytics reported that 25% of app users download an app and never return to it again. A notification can keep an app from languishing. The Legg Mason notifications, which you can see in this partial screenshot from my iPad, impart information without getting in the way.

With more adoption and maybe a tad more user education about how to control notifications and with some common sense on your part about what’s push-worthy, alerts and notifications may be worth your consideration, particularly for financial advisor segments. What do you think?