Time’s Up: Mobile-Friendly Websites To Be Rewarded, Others To Be Penalized

/ TweetHere’s where the rubber meets the road.

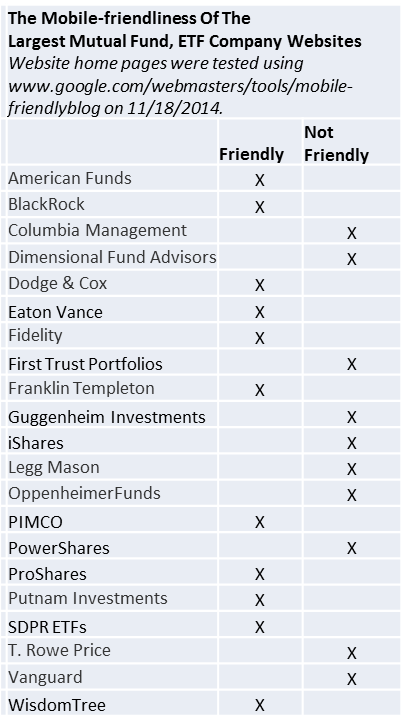

For the last several years, Website publishers including mutual fund and exchange-traded fund (ETF) firms have been encouraged to focus on the mobile user’s experience. This includes reducing the time a Website takes to load on a mobile device and enabling the taking of action via call-to-click functionality. While Google has been leading the charge, Bing also is checking sites for “mobile compatibility.”

But yesterday Google made it all real with the announcement that it will be adding a mobile-friendly label to mobile search results. At the same time, it acknowledged that it’s experimenting using mobile-friendly criteria as a ranking signal.

Awesome And Not Awesome

If your firm has made your site’s mobile friendliness a priority, it's all good. As Google rolls out the mobile-friendly label in the next few weeks, you could conceivably benefit from the designation and possibly a boost in Google search engine rankings.

But a spot-check yesterday of the largest asset management Websites, using Google’s mobile-friendly test, suggests that many firms have work to do. Note that root domains were tested, I noticed that some firms with mobile-unfriendly sites have mobile-friendly blogs.

But a spot-check yesterday of the largest asset management Websites, using Google’s mobile-friendly test, suggests that many firms have work to do. Note that root domains were tested, I noticed that some firms with mobile-unfriendly sites have mobile-friendly blogs.

In addition to returning either an "Awesome" or "Not mobile-friendly" result, the tool's analysis provides specific reasons and information on how Googlebot sees the page. The tool is part of a developer's guide to mobile-friendly Websites.

The Consequences

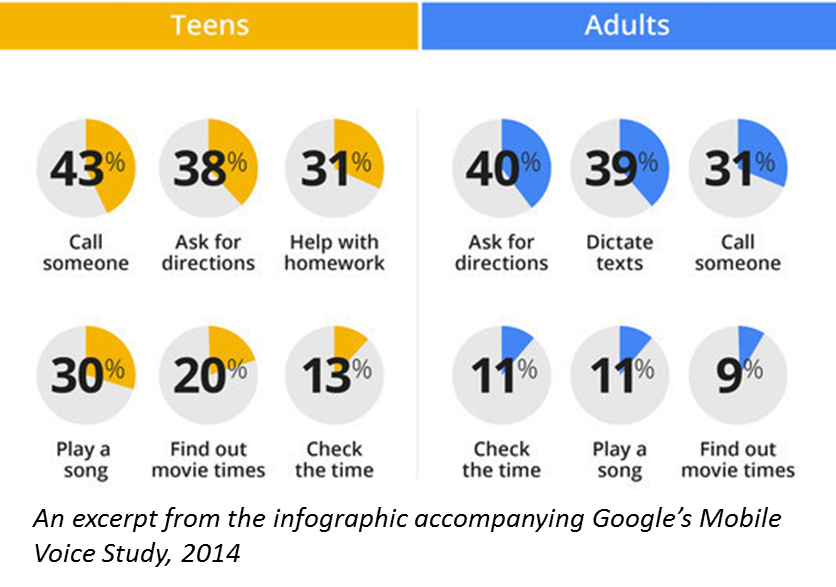

The desktop computer is no longer the leading way people access the Web. As reported by comScore, by July, 60% of U.S. digital media time was being spent on mobile devices. Financial advisors, in particular, use smartphones and tablets.

If there was any doubt before, it is now crystal clear that Google is serious about eliminating frustration for mobile searchers. When text is too small, links tiny and sideways scrolling is the only way to see all the content on a mobile device, a site will be penalized.

If there was any doubt before, it is now crystal clear that Google is serious about eliminating frustration for mobile searchers. When text is too small, links tiny and sideways scrolling is the only way to see all the content on a mobile device, a site will be penalized.

At the minimum, a ranking boost for sites that are mobile-friendly disadvantages the unfriendly. But also last month Search Engine Watch reported that Google was testing a mobile-unfriendly icon in search results. It’s unknown if a decision was made to eliminate the negative and accentuate the positive but OMG. No brand or Web team wants that badge of shame.

Here’s hoping you do whatever you can—as soon as you can—to avoid the unfriendly label and the resultant loss in ranking, traffic and relevance. I'm working on the same with this site.