This Time It Was Different!

/ TweetBravo to all the investment company marketers who dropped everything this week in order to orchestrate (whether writing, editing, routing, cajoling) a stream of market and even some product communications to an information-hungry following.

Having tracked the industry's real-time response (shallow and slow—see this post from way back when) to the seemingly much worse September 2008 turmoil, I’ve spent the week marveling at the output prompted by the August 2015 market swoon. It was a quarter’s worth of work in a week, and it has been magnificent.

What explains the difference in response this year from seven years ago?

Firms today are much better equipped to communicate in fresh, short bursts. Everything that’s been done—all the scoping and planning and building of a content publishing infrastructure—has led to this moment. Advisors, investors, the media all turned to their online news sources and (many of) you were there.

Of course, you accepted invitations to television and radio programs and other places where your investment experts were invited, and you sent emails with PDF updates to the advisor names in your database. That's old school. Most impressively, you found a way to get yourselves to where others were online and you contributed to "the conversation." Yay for you and everyone on your extended teams.

I’ll leave others to react to the substance of what your firms had to say. The notes below focus on what you did.

Tweets, Obviously

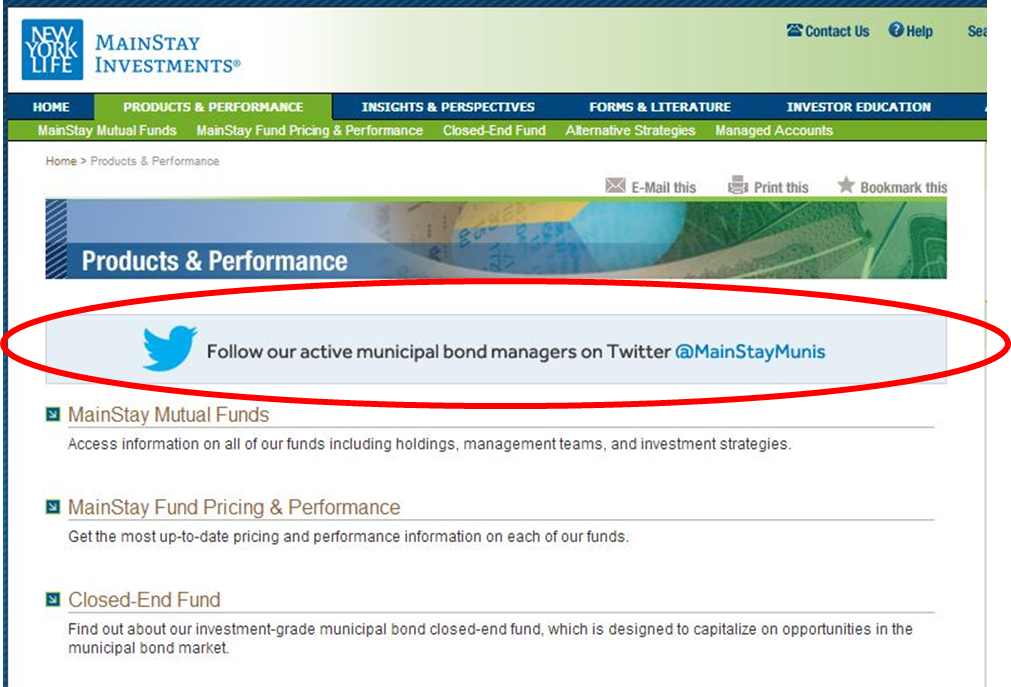

Twitter, the pet platform for breaking market information, was the quickest, no-friction way for asset managers to communicate.

Starting on Friday, market-aware tweets were posted to deliver simple messages to investors, and to notify advisors of hastily scheduled conference calls.

Firms used Twitter to circulate information—see how Fidelity’s Jurrien Timmer tweeted a New York Times graphic that the @Fidelity account and 21 others then retweeted. Isn't it great to be part of a village?

I happen to love how Nuveen’s Bob Doll used Twitter to provide some added info around a CNBC tweet quoting him.

Those Blogs Come In Handy, Don’t They?

It’s wondrous what can get done when there’s a publishing system in place, with a known process and identified roles and responsibilities.

Of the 50 or so asset manager blogs I subscribe to (see related post), maybe half had published a market-specific post by Wednesday. In fact, I was surprised by a few that didn’t (why launch a fund 30 days ago if you’re not ready to use it for this?).

Each firm has its own challenges, I get it. But for those with content benches, this was the time to show them off.

It wasn’t a surprise that the Eaton Vance blog was all over what was happening, given that volatility is one of its three investing themes. The firm posted no fewer than 13 updates in the last three days (nine on Monday alone). And, they had some recent Advisor Top-of-Mind Index survey work (more content marketing!) to be able to cite.

Not everyone could whip up visuals on such short notice. This may be one of those rare times when all you needed were words.

Notable: The Columbia Management blog had a table at the ready listing crisis events since 1929. I’d show you but the warning on the site about further distribution discouraged me and probably others from sharing.

I’ll also call your attention to a little visual relief on the Guggenheim commentary, which doubled as a readymade (and provocative) tweet. Clicking on the callout goes to the @ScottMinerd tweet and five tweets responding. My former colleague and buddy Todd Donat tells me it’s just a matter of HTML playing nice with the style sheet.

Cut, Print And That’s A Wrap

I believe First Trust was first out of the gate Monday morning with a video report (unembeddable—click on the link to view). “Yes, it is a correction…” is about as unambiguous as it gets.

And the directness of the Nuveen video, Bob Doll again, is quite effective.

For Facebook, Photos

Asset managers also reached out on Facebook, appropriately so as it was recently reported that Facebook is the leading source of news for affluent millennial investors.

Content posted was mostly images with and without links, as shown in these Putnam and Fidelity screenshots.

Did Any Of It Make A Difference?

There can be a bit of skepticism when people see Marketing types hustling around the office trying to get something out. Does any of it really matter?

Consider this: That Bob Doll video mentioned above? From Monday to the close of business Wednesday, it attracted about 800 views—easily more than 99% of the months-old videos on Nuveen’s YouTube channel.

Others from Northern Trust and Vanguard saw similar fast builds. Franklin Templeton’s video featuring Dr. Michael Hasenstab, recorded Tuesday and published Tuesday as the others were, was closing in on 1,200 views this morning.

I haven’t mentioned LinkedIn yet. That’s because I saw just a few asset managers jump on it Monday or Tuesday. Those who did posted a few links and linked somewhere else or cross-posted their blog updates to their Company pages. My impression of this week's content on the Banking & Finance channel is that it was prepared well before the breaking news.

However, LinkedIn appears to have been the site of most sharing of asset manager content published elsewhere. I say this based on a spot-check of Buzzsumo data, and it's consistent with what we've seen previously.

Franklin Templeton really got the word out as its Macro View About Market Volatility post seemed to be everywhere I turned, including Advisor Perspectives. Courtesy of its blog, here's a look at where the two-day-old post was shared.

On Twitter, it was more about visibility versus retweets or favorites. Accounts may very well have grown this week, if only because of heightened tweeting. Few investment company accounts were using some of the more popular hashtags (#ChinaMeltdown and #selloff).

A decision may have been made to communicate with existing followers as opposed to using descriptive hashtags to garner attention. That’s debatable, and I would debate it.

And Product Updates, Too

Product updates are tricky for mutual funds, especially on the very day the market is tanking and the fund has yet to be priced. Still, Wells Fargo found an elegant way for their portfolio managers to say something on Twitter.

In the glass half-full department, a few firms saw fit to comment on the "absence of volatility" among senior loan products.

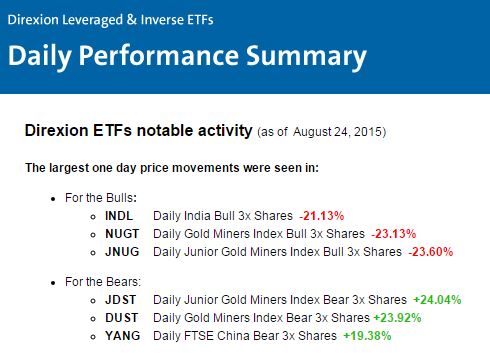

Direxion has been publishing daily "notable activity" reports, including notable one-day creation and redemption activity. Granted, Direxion is a firm that offers products, for traders, that benefit when the market goes in either direction. Still, this is added data (screenshot below is an excerpt) that I don’t recall seeing published in 2008.

Props also to @DirexionINV for using Twitter to acknowledge pricing issues. Other firms with Twitter accounts had problems, too, but didn't think to use the channel. When something's not working on a Website, Twitter is the first place many people think to look.

Many tweets directed to ETF providers and about ETF tickers went unanswered. Next time—and let’s hope it’s not as soon as next week—I’d look for ETF product providers to be more responsive in close to real-time. In the near term, I’m guessing many of you will be firing up stop-loss order explainers.

Finally, I’ll close this with a nod to @AdvisorShares, one of the most consistently entertaining asset manager accounts. To data only the CEO has retweeted it, but I’m sure I wasn’t alone in appreciating this tweet.

Is it Friday afternoon yet?