What's New For You In The Latest Research On Financial Advisors And Social Media

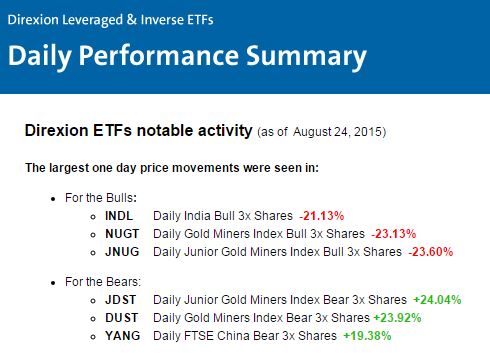

/ TweetFor an asset management marketer’s purposes, the best surveys of financial advisor social media adoption and usage are conducted by other asset management firms.

Their questions tend to be most tailored to what mutual fund and exchange-traded fund (ETF) businesses need to know. For example, fund companies know it’s important to capture the interest of advisors who are restricted by their firms from full participation. In fact, the latest data suggests that about one in five advisors consumes social media content passively.

And so, the release of two surveys—one from Putnam Investments and the other from American Century Investments—in the last two weeks presents us with an embarrassment of riches.

Let’s acknowledge upfront, though, that advisors have been surveyed on this subject for years now. Little in the new work is eye-popping. What's impressive—and encouraging for social media strategies—is that adoption continues to build across the board. There doesn't seem to be the fickleness that’s been seen among consumer use of various social networks over the years.

The 2015 research offers a few incremental insights, and there are some differences in the findings in the two reports.

On the assumption that the advisor trade publications will well cover what the research has to say about advisory business gains, where and why (and extensive detail on those firm restrictions), below I offer a few parochial notes about what I see in this research.

I recommend you check out the complete Putnam and American Century reports, including their different methodologies. The third annual Putnam survey of more than 800 advisors was conducted in partnership with Brightwork Partners LLC. This is American Century’s sixth annual report, based on a panel of 300 advisors, a sample provided by Research Now.

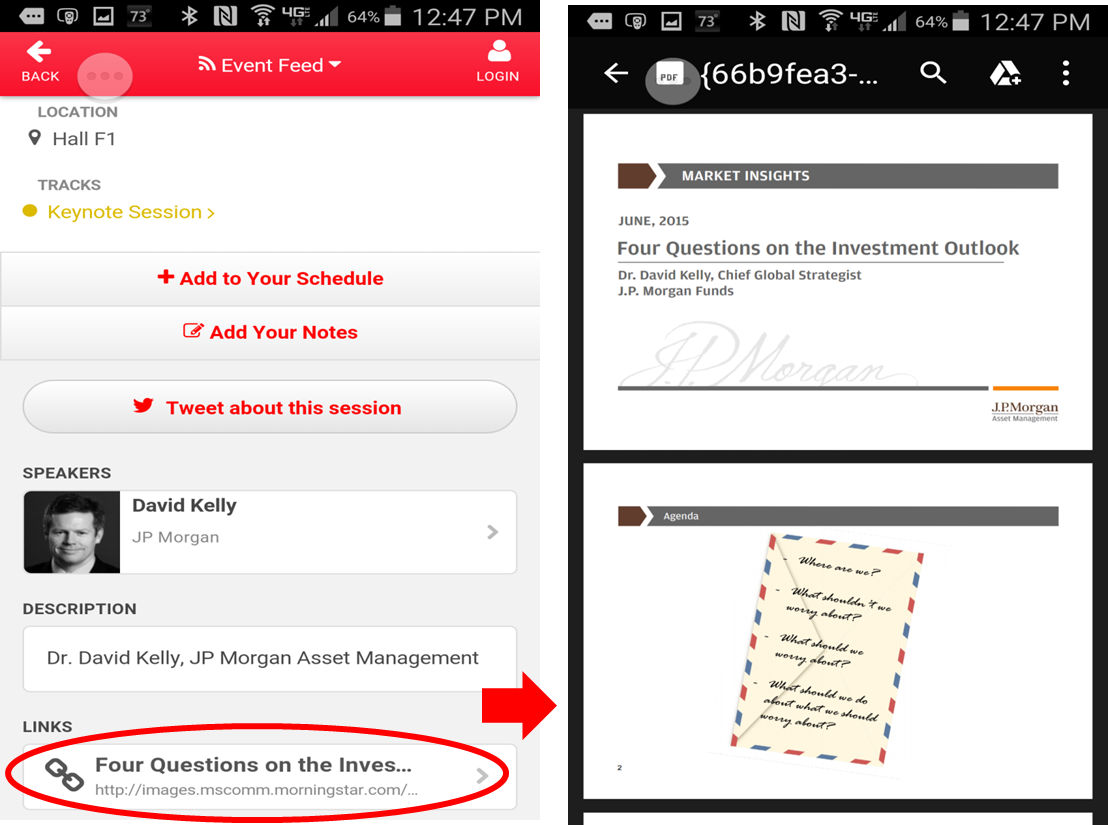

The 22-page American Century report can be found here. As a supplement to its press release, Putnam’s AdvisorTechTips blog has teed up an infographic and some high level data. Putnam tends to leverage the research by publishing additional findings throughout the year. My thanks to the firm for making the full report to me.

More Than LinkedIn

The comprehensiveness of Putnam’s data collection and analysis enables it to substantiate a fine point often overlooked in other broad-brush surveys: LinkedIn, Facebook and Twitter are the big three in the advisor's social toolbox and they are being used for specific reasons (click on the image to enlarge).

Putnam made the same point in its first survey two years ago, but the aggressiveness of LinkedIn marketing aimed at this space (and precious little targeted effort from the other networks) might lead you to believe that participating on LinkedIn will give you a lock on advisor attention. No.

The research found that advisor usage of Twitter for business and personal purposes grew 16 percentage points from July 2014 to July 2015. YouTube usage grew by 12 percentage points. That's my doing the math for you below on Putnam's graph.

And, according to responses to a separate question that explicitly seeks to understand any year-over-year change in platforms, Facebook is on top.

Almost six out of 10 (58%) respondents said their Facebook use has increased. The leading reason: That’s where the advisors’ clients and prospects are active. Four out of 10 advisors—even more from regional broker-dealers and banks—say that Facebook plays a “very significant role in [their] current marketing.”

Advisors On Asset Managers

No matter how many surveys surface in the year, I believe I’m safe in saying that American Century is the only firm that 1. Asks advisors how asset managers are doing 2. Publishes the responses. Thank you for that, American Century.

You have to love the big strides noted in three of advisors’ four answers to the question about their opinions of asset manager use of social media (emojis added by me).

A subsequent question gets down to brass tacks, leaving little room for doubt that advisors favor non-promotional non-firm-centric content. More than half say they’d follow an asset manager for content they can’t get elsewhere.

In another question, the ease-of-use of the social site is cited by 42% of the respondents, and that’s a datapoint I’d pay attention to. Whether via any one of the major platforms, content finds the social media-using advisor—the advisor doesn’t need to go to each (often password-restricted) site in search of what you're offering that's new and valuable.

American Century’s 2012 study was the first to report that LinkedIn Groups were the most important social media offering an asset manager could offer. I didn’t understand it then or in successive years, as it’s continued to be top ranked in the study above blogs, Facebook pages or Twitter feeds. Hmm, dunno.

Did anything in either of the surveys catch your eye? Please comment below.