Measuring Mutual Fund, ETF Content Marketing Effectiveness

/ TweetI invite you to join me on a tour of two (virtual) rooms.

The first room we enter is well lit. Lining the walls are neatly stacked, carefully labeled shelves. A handful of focused professionals staff the room and yes, let’s say they’re wearing pressed white lab coats. This is a room where there’s a place for everything and everything is in its place.

Now let’s walk down the hall to a larger room. We could enter the room through any number of doors. People are dashing in and out of all of them, tossing stuff into bins of all sizes scattered here and there. Through a haze, we see a few people who look like they’re in charge. Each has a clipboard; they seem to be sorting and tracking different activity. The overall feeling is one of lots of commotion but not so much order, coordination or meaning.

These are the scenes I flashed to when I read a Kurtosys survey result that content marketing has surpassed email marketing as the most effective digital marketing practice at asset management firms. (It wouldn’t have made a difference to the top rankings, but I wish display advertising and video channels also would have been included in the survey question.)

On the one hand, this is welcome news! Nothing has consumed the work of mutual fund and exchange-traded fund (ETF) marketers more over the last few years. I’m happy to hear that it’s believed to be working.

At the same time, I couldn’t help but wonder—and forgive me for this—how do you know?

Are You Winging It?

Email marketing has far fewer moving parts and, by now, most firms follow a structured approach to measure its effectiveness. At the most basic level, it’s known whether an email has been opened or clicked through. Firms know which emails have bounced and the number of unsubscribes. Those with marketing automation implementations are associating email interactions with sales-related activity and even revenue.

This work, involving a relatively small crew of specialists, has been mapped out and proven.

We’re trading up from a fairly well understood marketing tactic to a squishy, free-for-all of a content marketing assessment process. Granted, it’s early. But many firms appear to be winging it when it comes to evaluating their content marketing, declaring success by anecdote.

Survey respondents told Kurtosys that “Client Satisfaction” ranks as the most important metric for measuring digital marketing performance.

About this, Kurtosys ventures, “We’re not sure how they’re measuring client satisfaction, but presumably it’s through proprietary studies and client retention rates.”

Right. If client satisfaction is the most important metric, wouldn’t that mean that mutual fund and exchange-traded fund (ETF) firms have a system in place to link their top tactic to improved satisfaction?

I have my doubts. I don't doubt that financial advisors and shareholders/investors appreciate the industry’s transition from thin, periodic content to a rich stream of content, and I’d believe that a few are expressing their appreciation. But I’m skeptical that a direct line has been drawn from content marketing to client satisfaction. Or between AUM growth and digital and content.

If I hadn’t seen these results, I would have guessed that today’s key metrics have more to do with quantity and quality of “leads” and conversions because that what’s reported and easily counted.

Elsewhere, Kurtosys reports that four in 10 respondents consider “measuring marketing’s return on investment (ROI)” the biggest challenge to digital marketing efforts in the next year, second to compliance and regulatory restrictions. This echoes the cry for help that showed up in Boston Consulting Group’s benchmarking survey of asset management marketers, which I mentioned a few weeks ago.

If you’re committing to content marketing, if it’s your go-to digital strategy, I’d urge you to take a step back and make sure you have clearly articulated objectives and a system to measure the investment you’re making. Borrow from whatever discipline and rigor and control you have over the assessment of your email activity today.

When you’re awash with data (and the average content publisher is swimming in metrics), there’s the temptation to mix and match to tell the best story. Be careful with that. Being accountable while hoping to secure additional funding for continued content work mandates that you keep it both measurable and real, quarter after quarter.

Cookie Cutter Metrics Won't Cut It

I have some confidence in this research. Kurtosys, a specialist in the space (see their 2013 guest post on this blog), says its findings are based on nearly 200 qualified respondents representing a range of fund and wealth management firms of all sizes.

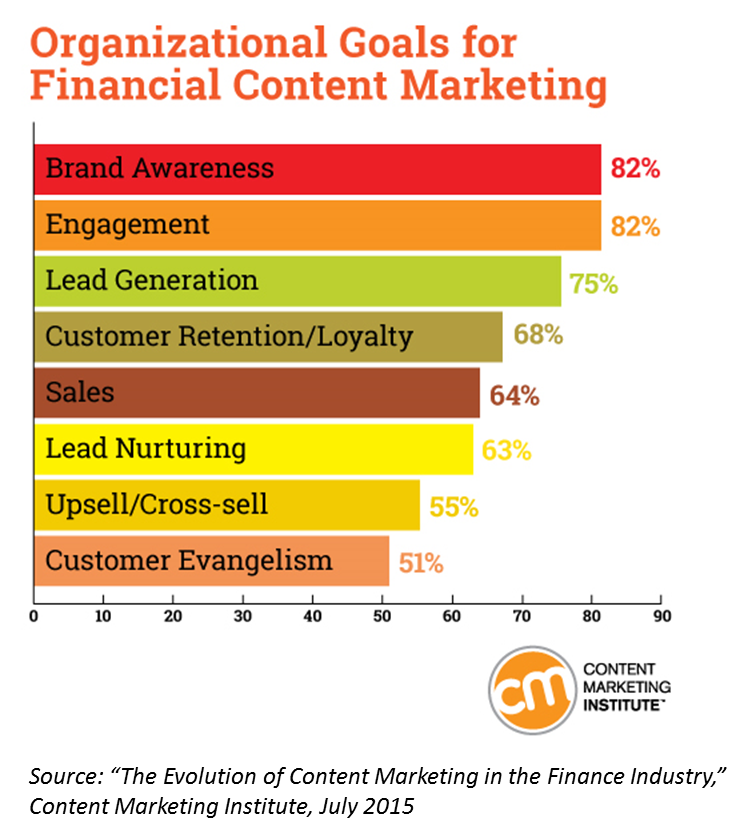

What I’d caution you about are the results of a broader financial services study recently released by the Content Marketing Institute (CMI). The CMI does outstanding work, but I’d argue that this research is of limited usefulness for the asset management marketer. (This isn’t unusual with “financial services marketing” reports.)

According to the SlideShare presenting survey highlights, the survey cast a wide net and collected responses from 5,167 representing a range of industries, functional areas and company sizes. The SlideShare report is based on 117 responses from a mix of B2B and B2C marketers in accounting/banking/financial institutions.

Note that the order of the organizational goals differs from what Kurtosys found (e.g., social media engagement is dead last in the asset manager marketer survey). But the list itself isn't at odds with what your firm's goals might be. At this point, I suspect brand awareness is a leading focus for content-producing asset managers, as well.

The CMI survey’s “metrics for content marketing success” are the reason I’m calling your attention to this—although only to suggest that you not pay attention.

The #1 financial services content marketing metric is Website traffic. That’s consistent with what typically ranks as the #1 metric for most industries surveyed, according to the CMI.

Website traffic and time spent on sites may be appropriate for retail banks. For asset managers, a campaign-related traffic spike is thrilling, to be sure. And, I’ll confess to an ongoing curiosity about mutual fund and ETF Website traffic levels.

But site traffic cannot be the endgame for a marketer whose products are distributed by intermediaries or other platforms. The effectiveness of what you’re doing with your content is going to be seen elsewhere, including far afield from your own domain.

You deliver your full blog content via RSS feeds, you publish to LinkedIn, Twitter, Facebook and media sites, your videos are viewed on YouTube, your value-added work is distributed at events or on partners’ sites, etcetera.

The risk of winging it or of defaulting to off-the-shelf financial services industry metrics is that they will unquestionably understate the value of what you and your team have been up to.

I’d like to see you march into that messy content measurement room and throw a lasso around everything you’re producing and delivering, including where, how, for whom, by whom, why and at what cost. Only then will you have a handle on the totality of your effort, and you will be on your way toward strategic thinking about how to measure its reach and impact.