Fidelity, iShares, T. Rowe Price Most Aggressive In Paid Search

/ TweetUpdate: In my sugar haze, I inexplicably overlooked Fidelity, by far the largest paid search advertiser in our space, according to Spyfu.com! I corrected this post a few hours after publishing it.

I have a secret weapon that I use when I want to get something done. It’s called a generous bowl of Trix Swirls (whole grain, naturally). It’s not just for kids.

Having powered up on some Trix the other day, I set out to finally answer a question I always wondered about: Which mutual fund companies and exchange-traded fund (ETF) providers are the most aggressive in paid search?

Organic search success—how much traffic your site pulls in from search engines—is a function of many variables influenced by: the quality, quantity and uniqueness of your content, the size of your company, the extent of your online relationships, how your investment products are distributed, the number of your shareholders, etc.

If your site dominates search engine results on important keywords or if you're satisfied overall with the other marketing tactics you're using to support campaigns or raise general brand awareness, maybe you don’t need to compete using paid search.

What's important is that you understand the competition that's happening online. Trix isn’t just for kids and competing isn’t just for salespeople in physical settings. Mano a mano combat may not come naturally to mutual fund and ETF marketers. But, you've seen first-hand how the business environment has changed.

“Fat profits may be long gone for asset managers” was the headline on a Reuters report this week, with consultants and others concluding—as they have before—that revenue compression will force firms to be more competitive.

Paid search is a credible way online marketers can compete. Companies that pay for search traffic are expressing a vote of confidence—they’re not content to wait for a search engine spider to find what they have to offer or to work their way up the search engine results pages. The paid search advertiser is trying to making something happen.

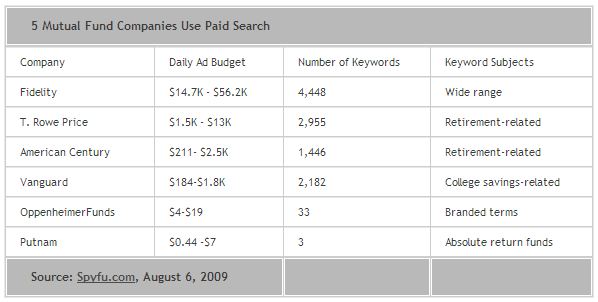

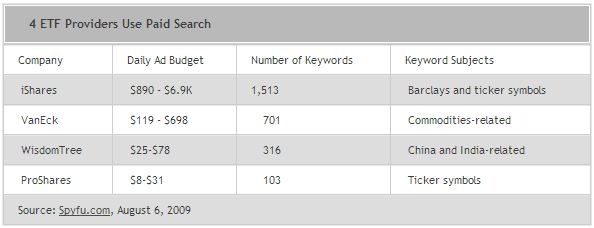

Below we’ve used Spyfu.com to look up the top 25 mutual fund companies and the top 10 ETF providers in the broad investment management space. You can find a wealth of competitive information on Spyfu at no charge; a subscription will unlock the keys to much more. If nothing else, check out who's competing by advertising against your company's name. The Spyfu data isn't gospel, I have my doubts about some of the keywords reported and there are wide variations in the daily ad budgets. But our experience suggests that the reporting is sufficiently reliable to make some general conclusions.

Just nine out of 35 mainline financial services companies are availing themselves of a proven online marketing tactic. Make that 13 if you add in some advertising Spyfu says American Funds, MFS, Columbia Management and PowerShares did last year.

Look at the spending differences between the top four—iShares, T. Rowe Price, American Century and Vanguard. This isn't surprising. At times during my browsing it seems as if they are the only companies out there. Good for them—and when you go to Spyfu, you can see the reported estimated results of their paid campaigns. With such a measureable medium, they wouldn't be spending at these levels if they weren't encouraged with the results.

What about your company and what your company has to offer? We’ve written before (and download our ebook for additional commentary on content syndication) about the need to get out of your own house, to meet some people off your own site.

Paid search is an added expense that requires careful planning and testing. It would represent new work but it's work worth the consideration of serious competitors. For the energy boost, I (but maybe not your nutritionist) recommend Trix.