5 Early Wins For Mutual Fund, ETF Companies Using Social Media

/ TweetI couldn’t get enough of the coverage this week of the 25th birthday of the World Wide Web, celebrated yesterday.

Originally, this post was going to be about what the Web has done for mutual fund and exchange-traded fund (ETF) communicating, with a few reminiscences.

For example, I smiled when I read this line from the inventor of the Web, Tim Berners-Lee, on a Google post Tuesday.

Thanks to the Web, Berners-Lee wrote, “You can link to any piece of information. You don’t need to ask for permission.”

Right, I’d forgotten! In the late 1990s, wirehouse account people actually asked for permission to link (their Intranets) to mutual fund company Websites. Ah, the innocence of those early days.

Instead for today, I’ve gravitated toward something fresher and, at this point, evolving more dramatically: The effect that participation in social media is having on how fund companies communicate with their many stakeholders. Let’s date the start of this to four years ago, right about when FINRA released its Regulatory Notice 10-06 in January 2010. I can think of five early wins.

1. Communicating at a higher level than product

As an example, access to Twitter came at just the right time for asset managers willing to provide a steady stream of information about municipal bond markets.

Starting in 2010 with Northern Trust’s @Fixedology account (since renamed @NTInvest) and followed by municipal-focused @RochesterFunds, @MainStayMunis and other broader asset manager accounts, 140 characters have proved sufficient space for pithy updates about markets, issue sizes, demand, etc. all clustered around the #muni hashtag or derivations.

In the last four years, what's going on with municipal bonds has been a topic that many others, and most notably the media, vitally cared about. Twitter provided asset managers an easy entrée into a conversation they could contribute to.

The notion that muni communicators could use a different communication channel to call attention to in-house insights or even just facts was new. Until 2008 or so, it was the equity funds, their stories and their management teams that typically dominated the marketing and public relations resources. And, regardless of the asset class or the timeliness of the comment, there would have been a limit imposed on the number of communications PR would have been willing to initiate—as in, "We can't reach out to a reporter on the same topic too often."

But, a Twitter account can. I’m convinced that steady, consistent communicating served the tweeting firms in good stead when, late in 2010, Meredith Whitney predicted a municipal bond "day of reckoning."

A crisis was avoided but the accounts tweet on, as shown in this random collection of information-packed Rochester Funds tweets. Note that many #muni tweets simply impart information, don't even require the reader to click a link.

Net revenue collections for FY ’14, July – Feb, in Puerto Rico are 10.2% higher than last year. Higher revenues = positive for bondholders.

— Rochester Funds (@RochesterFunds) March 5, 2014

Meeting today with some Puerto Rico creditors in NYC. We were not invited, nor will we attend. PR wasn’t invited either.

— Rochester Funds (@RochesterFunds) January 16, 2014

We agree with @Muni_Mkt_Advisor's Robert Donahue: "Puerto Rico's leaders are showing considerable courage” h/t @TheBondBuyer

— Rochester Funds (@RochesterFunds) December 26, 2013

Look for more of this social media-enabled content leadership, as the industry educates on alternative investing in particular.

2. Better customer intelligence

Some firms have a much better understanding of the financial advisors who use their mutual funds or ETFs than they did five years ago.

Because of the benefits to them of participating on social networks, advisors have been creating profiles and sharing information—all of which savvy asset managers recognize as valuable customer intelligence. (See this 2009 post for an early perspective on the opportunity.)

When third-party data providers (like Meridian-IQ to name a current-day example) first made advisors’ AUM and production data available, that was the first step in asset managers growing their customer databases with more than just the uneven data input by the wholesaling staff. APIs available from LinkedIn and other social platforms today and CRM integrations available provide real-time, qualitative information that salespeople know how to use to advance offline conversations.

At the 1:14 mark of the following Nimble video, you'll see an example of how social account information is being added to CRMs.

Nimble Grid View and Smart Summary of Contacts from Nimble Marketing on Vimeo.

It is the rare investment company that is mining this data today. However, many firms are doing something, even if in a low-tech way, or by just adding social CRM to their roadmaps. This will provide a competitive advantage.

3. Better visibility for initiatives

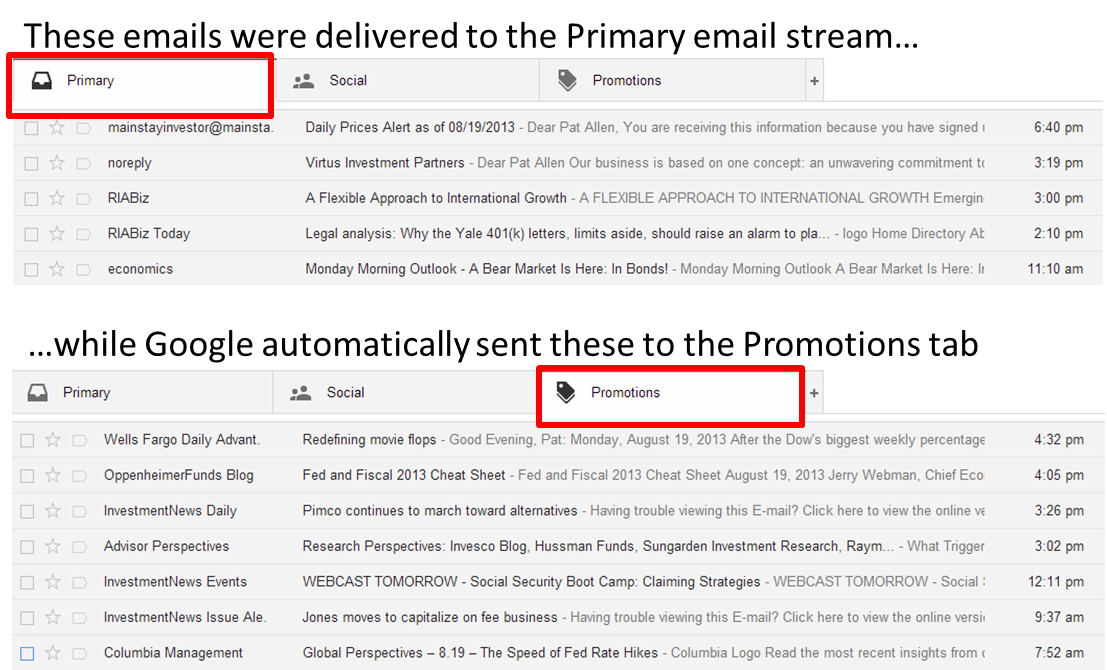

It can be a thrill to work for a firm with millions of shareholders or investors. However, communicating with them in print usually takes too much time and is cost-prohibitive, two challenges somewhat addressed by the advent of Websites and email. But there, too, there are reasons to take a measured approach. A firm can’t communicate “too often” for fear of fatiguing its lists, and no single initiative can consume too much of the enterprise's communication resources.

Enter Facebook, an extremely accommodating environment to discuss corporate responsibility and community initiatives and to foster engagement. Check out the John Hancock Boston Marathon posts for one timely example.

Or, consider the single-focus opportunity that a blog affords, as Putnam demonstrates with its five blogs on five niche topics: perspectives, wealth management, advisor technology tips, retirement and absolute return.

Putnam is also giving a master class on how to use social media to extend the value and life of research findings.

Do you remember the social media research Putnam released last October? Previously, a firm might have conducted research, prepared a whitepaper, launched a microsite, issued a press release and then its news would fade from the news cycle in about a week. Because the research was right on-point for its Advisor Tech Tips blog, Putnam continues to post additional survey-based insights, which in turn prompts sharing and new attention for the research.

4. More natural exchanges

When you talk to people only periodically, there’s a tendency to be more formal and need to say more. Four times a year-reporting means that there's always going to be a lot to have to catch people up on. Updating via social media, though, can be more conversational, even natural.

For its plain-spokenness and word economy, this @Vanguard_Group tweet (which was as a Rock The Boat Marketing 2012 content highlight) continues to be one of my all-time favorite asset manager communications.

Our Advisors app for iPad product comparison tool was too slow. We fixed it. Try it now. http://t.co/Ltoduy5r

— Vanguard | Advisors (@Vanguard_FA) November 17, 2012

We all know how this would have been approached in every other medium—a lot of background information, a mumbo-jumbo quote and a description of the app’s new capabilities. It’s hard to imagine a Web page with just these three sentences on it. The best fund companies on Twitter are keeping it real. (Also, see 2013: Time To Show Some Personality (And All That Implies).)

Theoretically, there’s no better way to project naturalness than to sit in front of a video camera and talk. Except that over the years, investment professionals and the perfectionist marketers who work with them have developed a lot of good habits that could use some relaxing to truly succeed on YouTube.

Here again, the Vanguard channel is blazing a trail toward less stilted presentations. Check out their first Google Hangout from December. There are a few rough spots but the fresh, uncanned approach has a contemporary appeal.

Vanguard, one of the first whose blogs allowed comments, is also one of the first money managers to allow Discussion on YouTube. It's inevitable: Through its interactions on Facebook, Twitter and in comments elsewhere, this business will get the knack of responding to investors and others in public.

5. Developing a fuller sense of the ecosystem

In pre-social media days, the enlightened asset managers acknowledged that their business was influenced by people not defined by AUM and sales. Hence, the gatekeeper-type field in a CRM.

But paying attention to social media conversations and interactions surfaces others—industry leaders, investment bloggers and service providers and vendors, also with no production data next to their names. These are influencers that those of us in marketing would have had no awareness of 10 years ago.

Let’s take the example of Cate Long on Twitter, writer of Reuters’ Muniland blog and very influential on the #munis subject with journalists among her top followers. She regularly tweets asset manager (and others') #munis tweets. Of course, she’s in PR’s Contact list, but marketers watching the #munis hashtag know about her, too.

This awareness should be institutionalized—if Long were to sign up for an email newsletter or call in on the 800-number, she should be recognized as someone other than a "non-advisor" in the enterprise CRM.

See where this is going? It’s silo-busting and calls for added collaboration across functions.

A systematic understanding of social networks, as some early adopting firms are starting to develop today, can lead to a fuller sense of the thinking influencing the users of investment products, and result in proactive communicating and marketing.

In what other ways do you see the business being changed by social media? Please add your thoughts below.